Your business typically receives a flood of invoices and bills at the end of the month. The tedious task of clearing every vendor payment, paired with internal financial approvals, can quickly become overwhelming. But accounts payable providers designed their services specifically for situations like this.

When your in-house AP team stretches thin, you can delegate all AP tasks to an accounts payable outsourcing company. This frees up your internal team’s time so they can focus on more strategic or complex financial work.

But are accounts payable outsourcing services a cost worth paying for businesses? In this article, we’ll walk you through what accounts payable outsourcing is, its key benefits, potential risks, and when it’s actually worth considering.

What Is Accounts Payable Outsourcing?

Accounts payable outsourcing services are just as they sound: delegating your daily AP tasks to a third-party company. These AP processing agencies and providers have the team and tools to manage your entire AP process. They handle tasks like:

- Invoice Processing: Invoices are received, approved, and recorded digitally.

- Payment Disbursements: Payments are issued on time to vendors and suppliers.

- Vendor Management: All vendor queries and relationships are handled smoothly.

- Reporting & Analytics: Reports on cash flow and payables are shared regularly.

- Regulatory Compliance: Every payment follows legal and industry standards.

- PO Matching: Invoices are matched with purchase orders to prevent errors.

Businesses with seasonal invoices, global operations, or heavy AP needs often hire outsourced staff. This helps them process invoices faster. AP automation is also an option nowadays for many businesses; however, it has limited applications, which we will talk about later.

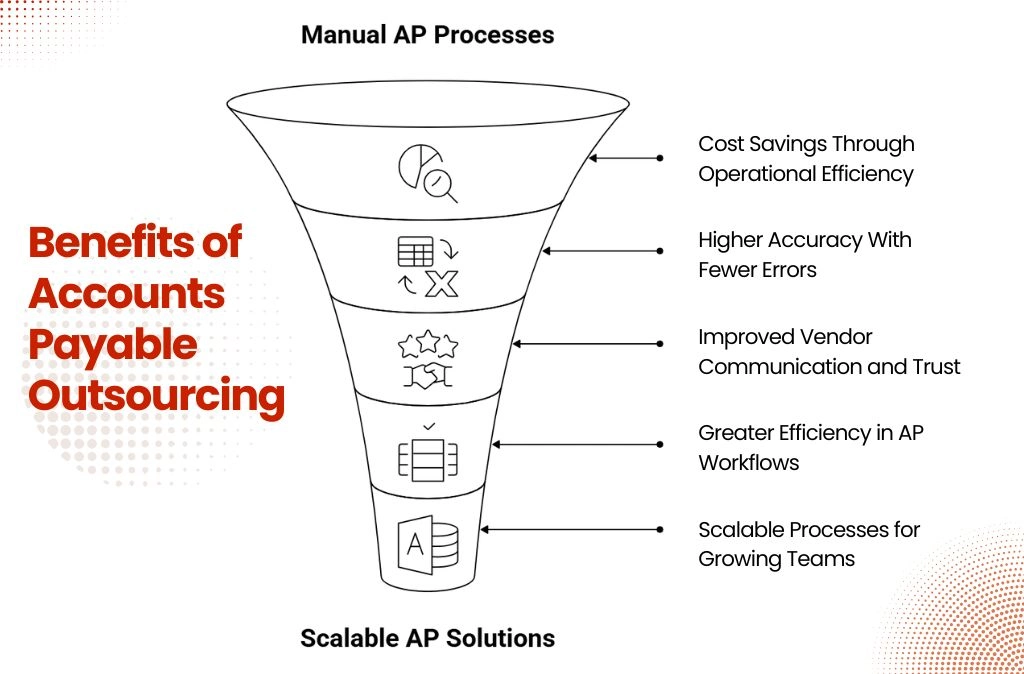

Benefits of Accounts Payable Outsourcing

Accounts payable is one of the most important functions of a finance team. Any errors or processing delays can become a serious problem. However, outsourcing accounts payable comes with more benefits than you might expect. It’s not only more cost-effective than manual, in-house AP handling, but it’s also faster and more reliable in many cases. Let’s learn more about these benefits:

1. Cost Savings Through Operational Efficiency

When you outsource AP services, you skip costs for hiring, training, infrastructure, and accounting tools. Outsourced accounts payable providers already have built-in infrastructure, advanced automation tools, and typically operate in low-cost jurisdictions. This significantly reduces business and operational costs, making accounts payable outsourcing far more affordable.

Businesses also benefit from flexible pricing: you pay only for what you use. That means your business converts fixed staffing costs into variable expenses based on invoice volume. For example:

If you get 1,000 invoices monthly and are paying $3,000 to AP outsourcing services, you are actually only paying:

$3,000 ÷ 1,000 invoices = $3 per invoice

Many SMEs and enterprises that need dedicated and scalable AP support find the low per-invoice processing cost highly affordable.

2. Higher Accuracy With Fewer Errors

Most accounts payable outsourcing companies use robust quality control frameworks and high-accuracy AP automation software. These systems help them consistently deliver data with over 98.7% accuracy, a major improvement over error-prone manual entry.

Here’s how AP outsourcing companies improve accuracy:

- They standardize invoice formats and processes across vendors, which makes reviewing and approving payments faster.

- AP outsourcing companies run built-in checks to catch duplicates, mismatches, and missing details before paying invoices.

- Outsourced teams fix exception invoices fast, so vendor payments stay on track.

- They maintain audit trails and documentation for every transaction, making audits and reconciliations much easier.

3. Improved Vendor Communication and Trust

Many businesses choose trusted accounts payable outsourcing companies for their ability to maintain strong vendor relationships. These providers carefully manage approvals with expertise, not just to ensure timely payments, but to uphold vendor trust and satisfaction.

Your accounts payable provider will handle all queries, communicate payment status, and resolve disputes quickly. Using vendor relationship management tools can further streamline these processes and help maintain clear, organized communication with all suppliers. This will result in stronger business relationships, possible early-payment discounts, and greater trust in your operations.

4. Greater Efficiency in AP Workflows

AP workflows involve a lot of responsibilities, like processing invoices, approvals, and payments. The specialized technology and tools can help digitize, scan, and match documents, making manual labor almost low to none. Also, accounts payable outsourcing services make sure that delays are not a headache for the firm anymore.

The provider’s focus and expertise in AP eliminate bottlenecks and keep cycles running smoothly. For construction companies specifically, integrating specialized construction procurement software can further enhance these efficiencies by streamlining purchase order management and vendor coordination across project sites.

5. Access to AP Technology and Expertise

Maybe you don’t want to spend on multiple IT architectures to perform accounts payable tasks, then outsourcing is your best bet. You will get access to advanced tools, like OCR (Optical Character Recognition) for faster invoice digitization, machine learning for smart data validation, and real-time reporting dashboards for visibility and control.

The AP specialists and staff who are also onboard through this dedicated accounts payable outsourcing company will help you with other functionalities. These can be best practices, tax regulations, and industry compliance standards.

6. Scalable Processes for Growing Teams

AP outsourcing services grow with your needs. Whether you’re processing fewer invoices during a slow season or expanding into new markets, your outsourced AP team can grow or shrink accordingly.

You can easily add roles like AP director, specialist, or coordinator, without hiring or training anyone in-house. This makes it easy to adapt quickly to changing volumes without losing accuracy or control. As a result, you will be able to handle large influxes of invoices or expansion into new markets easily, without sacrificing accuracy or speed.

Risks and Drawbacks of AP Outsourcing

The more benefits you gain from AP outsourcing companies, the more potential drawbacks there are. They may seem minor when compared to the full benefits of accounts payable outsourcing; however, you should understand them fully before making an informed decision.

1. Onboarding and Transition Challenges

For smaller businesses and entrepreneurs, transitioning to outsourced AP teams can be challenging. One of the most common issues is the assumption that all work can be handed off immediately, which isn’t feasible. The planning, coordination, and adaptation phase can take up to a week or more, which some organizations may find difficult to accommodate.

During onboarding, internal AP staff may need to restructure invoice workflows, define approval hierarchies, and standardize document formats. There are also risks tied to compliance gaps, data migration errors, and integration issues between legacy systems and external platforms.

2. Reduced Process Control

Managing internal AP processes allows for greater oversight, but accounts payable outsourcing services may reduce your ability to control operational details. While many providers now offer improved transparency, you may still have limited influence over tasks like invoice approval timelines.

Even with SLAs in place, approvals, exception handling, and reporting may experience delays that don’t usually happen with an in-house team. Businesses with highly customized or layered approval workflows might find that standardized procedures don’t meet their expectations or internal pace.

3. Communication Challenges

Outsourcing accounts payable requires clear and consistent communication. This becomes even more critical for businesses with seasonal spikes in invoice volume, where any misalignment can lead to missed deadlines.

Some common communication challenges you may face are:

- Slow response times from the outsourced team.

- Unclear workflows that delay issue resolution.

- Difficulty coordinating across different time zones.

- Misunderstandings about invoice formats or approval hierarchies.

- Lack of a clear escalation process, causing minor issues to drag on.

Delays in responding to vendor queries, unclear invoice statuses, or inconsistent communication styles can damage vendor trust over time. Hence, making sure that communication is linear is quite important.

When Is AP Outsourcing the Right Choice?

Not every business may need accounts payable outsourcing right now. Many companies fall prey to expanding their structural approach to “try” outsourcing as an option. But, rather than deroot your internal AP team, you can first look for some signs to understand if now is the right time for you to outsource an accounts payable provider.

You are ready for accounts payable outsourcing services if:

- High volume of manual invoices.

- Strained AP team or frequent late payments.

- Difficulty managing vendors or reconciling payments.

- Expensive or inconsistent in-house processes.

- Industries or business types that benefit most.

Also, for your short-term financial understanding, it is always a good idea to choose accounts payable outsourcing. The experts can help you optimize your AP workflows so that you don’t suffer from unidentifiable financing mistakes.

Alternatives to Outsourcing: What About AP Automation?

If you’re unsure about fully handing over your accounts payable process, AP automation is a strong alternative. While outsourcing transfers responsibility to a third-party provider, automation tools allow you to manage invoice processing internally, without giving up control.

Benefits of AP automation include:

- You maintain full visibility and control over payments.

- It reduces manual errors and improves accuracy with OCR, validation rules, and AI-based checks.

- Faster processing times help you meet payment deadlines and avoid late fees.

- Dashboards and alerts make it easier to track invoices, cash flow, and approvals in real time.

When is automation a better fit?

Automation may be a better fit for you if you are an entrepreneurial organization. Also, if your invoice volume is consistent and your team has the capacity to manage payments with the help of software, AP automation might be more efficient than outsourcing.

But if you have tried AP automation and it still hasn’t solved your core problems, maybe you should consider a hybrid model.

Many businesses combine both: automation AP software for everyday processing and a specialized accounts payable outsourcing partner to handle exceptions, peak volume, or vendor management. This way, you get scalability and control at once.

How to Choose the Right AP Outsourcing Provider?

Selecting the right accounts payable provider is not easy. As accounts payable tasks are common, you may get the service for as little as $0.99 per invoice as well. But cheaper isn’t always better. Before you make the decision, look for smooth AP operations, compliance, and long-term value. Additionally, here are the core factors that can help you make an informed decision:

- Security standards: Look for ISO 27001, GDPR compliance

- ERP/software integration: Must work with your existing tools like QuickBooks or NetSuite

- Clear SLAs: Ensure transparency in timelines, issue resolution, and reporting

- Proven experience: Seek industry-relevant expertise and real client results

Don’t know an AP outsourcing provider with these qualities? Well, now you do!

Invedus brings over a decade of specialized experience in accounts payable outsourcing, with capabilities in ERP integration, multi-entity processing, and compliance with frameworks like GDPR.

Our AP teams are trained in OCR-based invoice capture, three-way matching, and exception handling workflows tailored to your business rules. With real-time reporting dashboards, dedicated account managers, and proven SLAs, Invedus ensures scalability and consistent process optimization, making us a strategic partner for finance teams aiming for efficiency without losing control.

Is AP Outsourcing Worth It for Your Business?

Accounts payable outsourcing comes with many benefits: cost savings, scalability, greater accuracy, and access to expert-level processes and tools. However, just like every financial decision, it has its own downsides.

That said, AP outsourcing is not for everyone. We briefed you that if you are overloaded with invoices, unable to manage vendors, or want to add new vendors, the best decision will be to onboard an outsourcing AP provider, like Invedus. But if your business runs on entrepreneurial or solopreneurial power with consistent invoice intakes, AP automation will be a better idea.

The key manner to take the optimal decision will be to evaluate your current AP structure: Where are delays happening? Are late payments affecting vendor relationships? Is your team stretched too thin, or are processing costs climbing?

These questions can help determine if outsourcing is a strategic next step towards financial efficiency or if it’s still too soon.