When it comes to payroll management, it’s not just limited to getting employees paid. In fact, it is a complex and time-consuming process that calls for constant supervision and precision.

Payroll complexity rises with business expansion, and accounting firms encounter numerous difficulties that may put a strain on their internal resources.

This process requires a high level of accuracy to ensure compliance with ever-changing tax laws and regulations.

Any misstep in payroll leads to costly penalties and affects employee satisfaction. To manage and create payroll effectively and efficiently, you need to hire a full-fledged accounting team. Which will cost you around $67,650 per year or $32.53 per hour.

Read: A Beginner’s Guide to the US Payroll Process

This is where outsourcing payroll comes into play, providing a flexible and strategic solution that enables accounting firms to reduce their expenses, streamline operations, and ensure adherence to constantly changing tax laws.

Though there are numerous payroll outsourcing providers available in the market. But which service provider should you opt for to manage your payroll services is a million-dollar question.

You cannot pick a random outsourcing player for your payroll services.

You need a partner who is skilled at smoothly managing and generating payroll. So, to ease your search below, we have curated a list of the top payroll outsourcing providers for accounting firms and other businesses.

What is payroll outsourcing?

Payroll outsourcing is the strategy when a business hires any third party to delegate their payroll tasks. These service providers are working beyond calculating wages, withholding taxes, issuing paychecks, and filing taxes. They are ready to serve you other services related to payroll.

List of Outsourced Payroll Services

You can (though not always preferred) delegate nearly all payroll tasks to an outsourced service provider. Responsibilities that can be outsourced include:

- Creating payroll accounts

- Setting up payment methods

- Monitoring working hours

- Calculating wages due

- Disbursing payments

- Implementing security measures to protect both company and employee data

- Ensuring adherence to governmental regulations

- Withholding payroll and income taxes, as well as garnished wages

- Handling employee deductions

- Submitting payroll taxes

- Completing year-end tax obligations

Why is payroll outsourcing a viable option for accounting firms?

Payroll outsourcing encompasses more than just creating or managing payrolls. Outsourcing payroll offers significant benefits for businesses of all sizes, helping them operate more efficiently.

Companies can streamline compliance monitoring changes to labor laws, tax laws, and regulatory deadlines with the assistance of their skilled HR professionals.

Furthermore, outsourcing enables you to concentrate on your core business since it handles a large number of your business-related tasks, freeing you up to give your full attention to the expansion of your company. It may surprise you to learn that 53% of companies use payroll outsourcing to streamline their operations.

The next advantage that companies enjoy is an error-free payroll process. The G2 reports that 40% of payroll errors are caused by manual data entry, and 49% of US workers consider changing jobs after two payroll errors.

Further moving, you don’t need to invest in new tools and technologies and spend a lot on your employees’ training. All your requirements are managed by your payroll outsourcing service provider.

Lastly, you as a business don’t need to bother with data security concerns because these payroll service providers will securely manage your data and store your data on safe clouds.

After having an overview of payroll outsourcing service providers and what they can do for your business, let’s have a virtual tour of these payroll service providers.

Top Payroll Outsourcing Providers for Accounting Firms in 2025

Find the details of top payroll outsourcing companies to help you make informed decisions.

1. Invedus

Invedus focuses on matching you with leading payroll professionals in India who are prepared to join your team as a natural extension. Our outstanding recruiters are well-versed in the accounting and finance industries, enabling us to identify applicants with the necessary training and expertise.

We assist accounting firms and other businesses in cutting hiring and operational costs up to 70% and find the top 1% of candidates who possess outstanding skills and are a great fit for your team.

Our stringent screening and recruitment procedure ensures that your accounting firm gets the best candidate and meets the highest level of excellence.

Invedus is loaded with exceptional payroll specialists based in India and London, including finance professionals like accountants, bookkeepers, and payroll specialists. We assist accounting firms in their entire hiring process so that businesses can get the best candidate for their vacant position.

Payroll Service Invedus Offers

- Timely payroll processing with precision.

- Tax calculation and filing services.

- Organizing payment methods

- Tracking Working Hours

- Processing payments

- Enforcing security protocols to safeguard company and employee information

- Ensuring compliance with governmental regulations

- Deducting payroll and income taxes, as well as garnished wages

- Managing employee deductions

- Filing payroll taxes

- Finalizing year-end tax responsibilities

- Processing of paper checks and direct deposit.

- Management and administration of benefits.

- Monitoring of time and attendance.

- Assist you in payroll automation

- Establishing payroll accounts

- Support for federal, state, and local compliance

- Easy integration with HR and time tracking

- Expert support around the clock

- Fully automated synchronization of employee data

Invedus provides additional financial services in the financing sector, including bookkeeping, accounts receivable, Quickbooks, and invoicing.

Industries and Expertise

- Accounting Firms

- CPA Firms

- IT

- Automobiles

- Travel & Tourism

- Medical

- E-Commerce

- 3D Modeling

- Retail

- Small and Medium Businesses

- Startups

Why Prefer Invedus for Payroll Outsourcing

- Your data is encrypted and secure.

- Best service price in the industry

- On-demand support

- Access the best expertise.

- Can avail all experience-level payroll specialists

- No obstacle to communication. Our payroll experts are proficient in your native language (English-speaking countries).

2. EQtax

E&Q Tax Accounting & Business Solutions is a financial service provider in New Jersey. They offer various tax services, including individual and business tax returns, payroll services, and more. Their commitment to each and every customer makes them one of the most reliable payroll service providers available.

Payroll Service EQtax Offers

- Payroll creation and management

- Income Tax

- Multiple State Filing

- E-Filing & E-Payment

- IRS Payment Plan Assistance

- Mortgage & Financial Planning

- Personal Financial Planning

- Tax Planning & Coaching

- Credit Repair Solutions

Industries and Expertise

- Accounting

- Bookkeeping

- Tax Solutions

- Payroll

- Consulting

3. Paychex

Paychex is a well-known payroll outsourcing company that is renowned for providing startups and SMEs with comprehensive solutions. Their payroll solution is not limited to paying employees. They also provide other financial services to their clients for convenience.

For a seamless payroll management transition, this outsourced payroll service provider helps companies gather the data they need for their initial payrolls.

Payroll Service Paychex Offers

- Payroll Services

- Small Business Payroll

- Compare Payroll Packages

- Midsize to Enterprise Payroll

- Switch Payroll Companies

- Payroll Protection

- Paycheck Pre-check

- ERTC Service

Industries and Expertise

- Professional services

- Healthcare

- Retail

- Manufacturing

- Construction and skilled trades

- Hospitality and restaurants

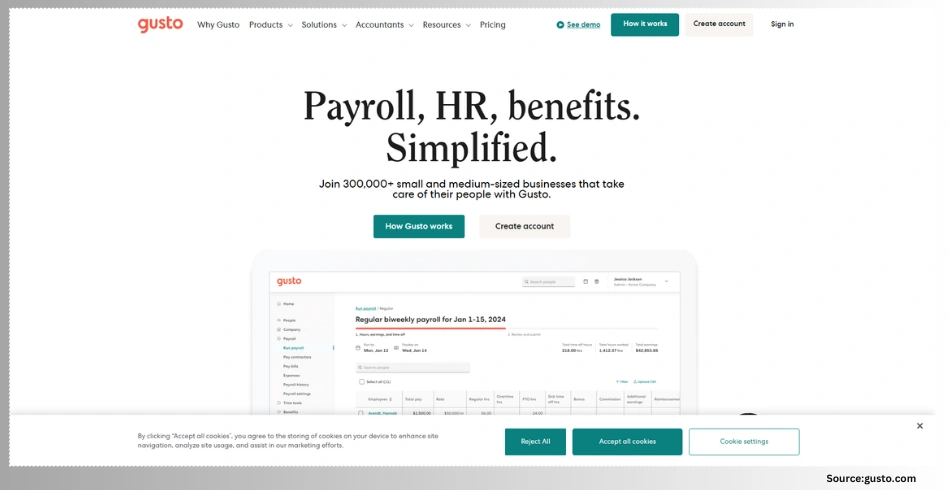

4. Gusto

Gusto empowers you to be productive rather than mingled in payroll. This online payroll platform is designed for almost all business sizes. This payroll provider provides services all over the world. This user-friendly platform creates its interface in such a way that payroll management is easy now for accounting works, which ensures a smooth process for businesses.

In addition, Gusto manages payments to workers and contractors in addition to the documentation required to assist client businesses in adhering to labor, immigration, and tax regulations.

Payroll Service Gusto Offers

- Online payroll services

- Payroll for new businesses

- Payroll with benefits and HR

- Secure payroll services

- Time tracking and attendance

- Talent management

- Recruit, hire, and onboard

- Remote teams

- Insights and reporting

- Health insurance plans

Industries and Expertise

- Real Estate

- Healthcare

- Retail

- Manufacturing

- Construction

5. SurePayroll

SurePayroll has dedicated itself to serving nearly every kind of business over the past 20 years, with a particular focus on small and medium-sized enterprises. They are leading the way in providing excellent customer service to their clients and ensuring that their users will not experience any payroll-related problems. Their core area of expertise is for small businesses and households to pay their employees swiftly, effortlessly, and in full compliance with the law.

Payroll Service SurePayroll Offers

- Calculating and paying federal, state, and local payroll taxes.

- Small Business Payroll

- Nanny & Household

- Accountants & Resellers

Industries and Expertise

- Small Businesses

- Nanny & Household

6. ADP

ADP is a reputable payroll outsourcing company that offers complete payroll and HR management solutions. They provide a broad range of payroll outsourcing services for businesses of all sizes, such as payroll processing, tax compliance, and employee benefits administration.

Accurate and secure payroll management is ensured by ADP’s advanced technologies and strong security protocols.

The company is a trusted partner for accounting firms looking for effective payroll solutions because of its extensive experience, staff, vast experience, and dependable customer service.

Payroll Service ADP Offers

- Payroll Services

- Payroll Outsourcing

- Payroll Processing

- Payroll Software

- Time & Attendance

- HR Insights

- HR Services

Industries and Expertise

- Information Technology

- Restaurant & Hospitality

- Manufacturing & Logistics

- Professional & Technical Services

- Construction

- Financial Services

- Retail

- Healthcare & Pharmaceutical

- Education

- Non-Profit / Charity

7. TriNet

The Trinet Group is a professional employer organization for small and medium-sized businesses located in California. They manage payroll and health benefits, provide clients with advice on risk mitigation and compliance with employment laws, and occasionally function as an outsourced human resources department.

Additionally, they can manage your company’s payroll and administration, giving you the choice to contract out your payroll function to their PEO service.

Furthermore, its staff of HR professionals will handle your payroll and tax administration while also providing problem-solving and consulting services.

Payroll Service TriNet Offers

- Benefit Options

- HR Expertise

- Payroll

- Risk & Compliance

- Technology Platform

- Contractors and Global

Industries and Expertise

- IT

- Healthcare

- Finance

- Retail

8. Rippling

Rippling is an all-in-one workforce management platform that helps companies handle IT, payroll, and human resources. It is intended to automate numerous tasks to save time and lower errors, as well as streamline employee operations from onboarding to offboarding.

This payroll outsourcing provider offers payroll outsourcing services for businesses of all sizes, facilitating both local and international payroll functions.

Riplng is efficient in processing employee data rapidly to ensure accurate and on-time payments. Implementing it is simple and demonstrates smooth integration with accounting software, time and attendance systems, and other platforms.

Payroll Service Rippling Offers

- Payroll

- Contractors

- Global Payroll

- Employer of Record

- Global Contractors

Industries and Expertise

- Construction

- Financial Services

- Healthcare

- Marketing & Ad Agencies

- Manufacturing

- Non-profit Organizations

9. JustWorks

Justworks is a payroll outsourcing provider dedicated to simplifying the complex payroll management process for companies.

They very well understand the unique needs of small businesses, allowing them to focus more on growth strategies rather than getting bogged down by payroll complexities.

The services offer the flexibility of unlimited payroll runs while ensuring accurate calculations, and they include user-friendly HR tools to improve people management.

It also handles statutory compliance, guiding making the correct tax deductions.

Payroll Service JustWorks Offers

- Payroll services

- HR tools

- Time Tracking

- Health & Insurance Benefits

- Paperless Paystubs

Industries and Expertise

- Biotech

- Construction & Skilled Trades

- Education

- Financial Services

- Healthcare

- Manufacturing

- Professional Services

- Real Estate.

10. Osource

Beyond monthly payroll processing, Osource provides intelligent solutions to streamline full and final settlement procedures, statutory management, and investment-proof verification services.

This approach reduces operational costs and eliminates manual intervention in payroll management, allowing for a more efficient process without relying on additional technology.

Employees are empowered by OSource’s employee self-service platform, which provides them with timely access to their paystubs and facilitates simple leave and expense approval checks.

Payroll Service Osource Offers

- Salary Processing

- Tax and Compliance Management

- Automated Solutions Integration

- Employee Self-Service & Customer Portal

Industries and Expertise

- Logistics

- Media & Entertainment

- Healthcare

- Manufacturing

- Insurance

- Banking & Financial Services

Last Words

Payroll outsourcing unquestionably offers accounting firms a number of advantages, such as increased accuracy, cost savings, and efficiency. By outsourcing your payroll duties, you can access specialized payroll knowledge without breaking the bank, focus more on your core business, and receive assurances regarding tax and compliance.

Selecting the best payroll outsourcing provider is essential to obtaining the advantages mentioned above.

With Invedus, skilled and talented payroll specialist businesses can save more than 70% on their operational costs. Additionally, they will have access to a payroll specialist who will oversee their operations without any issues.

Complete this form to connect with our expert client representative and learn how Invedus can revolutionize your business, optimize operations, and fuel growth for 2025 and beyond.