Every January, when the tax season starts, so does the worry for many individuals. Filing taxes isn’t a pick-and-done thing, it takes time, effort, and a whole lot of patience. People are busy, but tax filing can never be ignored. What if we tell you, there are tax preparers online who can do all taxes for you?

Yes, it is a fact! Many individuals, business owners, and traders choose to file taxes through paid tax preparers online. But as the new tax season arrives next year, it is best if you know how much it can cost you according to the forms you are eligible to pay for.

Read on to understand why you should definitely seek a tax preparer or a dedicated accountant to take care of your taxes and how much it can cost you. We will also guide you to the differences of all options, so you know what to look for to file your taxes next tax season.

What Factors Make Tax Filing Services More Expensive Sometimes?

Imagine you are an individual looking to the market for a reliable tax preparer. You will find one who files your taxes at a relatively reasonable price starting from $100. But every entity is different and so is the tax preparers fee for them.

This is just one of the factors that affect tax filing cost. Below we have discussed more reasons that can change the amount of money you spend and the cost to do taxes.

Cost of Tax Filings That Are Common

The cost of tax preparation is on the rise. But before you start blaming yourself for not knowing how to file taxes, it’s important to understand the common reasons why and how much it does cost to get taxes done, especially when using professional help. These are some of the most common causes that increase the final bill:

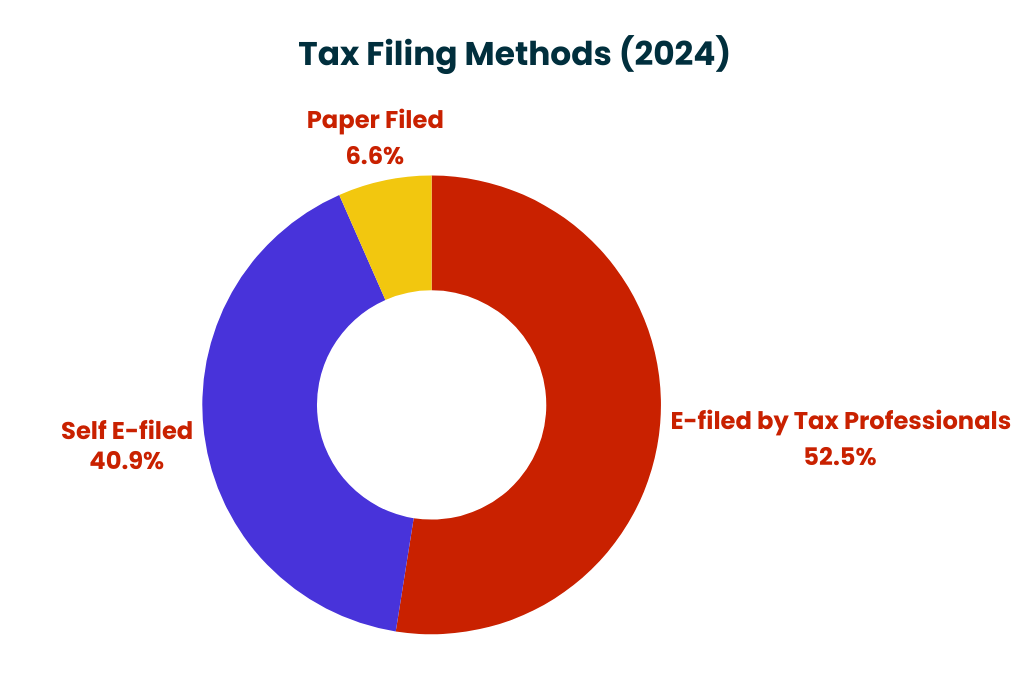

- Multiple Income Streams: If you have self-employment income, rental properties, or investments, your return will likely require additional forms like Schedule C or D. These can increase costs by $100–$500+. For example, a Schedule C (self-employment income) often adds $192–$200 to the base price.

- Business Entities: Filing for business structures like LLCs or S Corps adds significant complexity. Limited liability companies (LLCs) can expect costs of up to $750 to $1,500 for tax filings due to their huge business model and income streams. Also, a small business corporation can expect to pay $1,200 to $2,000 in tax filing fees.

- International Tax Filing: If you have foreign assets or income, forms like FBAR (Report of Foreign Bank and Financial Accounts) or Form 8938, you can add $250+ every form. International tax filings require in-depth knowledge, hence the price tag jumps significantly.

How Your Preparer, Location, and Records Affect the Price?

Not every tax preparer knows everything. We know how shocking. Sarcasm aside, it is quite important for you to understand the preparer you choose, the location you are in, and the record of your documents all can inflate the cost of tax filing services.

Three main types of preparers are approached every tax season for tax return filing. CPAs or Certified Public Accountants charge the industry average of $220 to $500 for individual tax filing and $800 to $3,000 for businesses depending on the size.

There are agents as well, tax preparers who you can outsource. These are the cheapest resources charging only $640 to $1800 to businesses and $100+ to individuals. This comes to about 20% to 40% cheaper compared to CPAs.

Lastly, there are specialists. These are tax professionals who work in specific areas, such as crypto or estate tax filings. The average cost of tax preparation for individual and business is very high, typically $300 to $600 per hour.

If you thought this was it, oh boy are you wrong. The location also plays a role in determining what your final tax preparer bill will be.

- Urban areas like NYC or San Francisco: $300–$800 for basic returns.

- Rural areas: $150–$250 for similar services.

- States with complex tax laws (e.g., CA, NY) increase prep time and costs.

This is especially true for people who may not be aware of local tax laws, such as the city income tax in New York, Gross Receipts Tax in San Francisco, Metro Supportive Housing Services Tax in Oregon, and Wage Tax in Philadelphia.

The biggest and wasteful average tax preparation fees gets added in the form of documentation and last-minute forms. Start to finish, documentation can cost you 1 to 3 hours of time in preparation and an additional $150 to $450 in fees.

If this isn’t bad enough, forms such as K-1s which go overlooked initially can cost you $100 to $300 per form in rush fees. These obvious record lapses can cost a business at least $1,000 to fix, which can be very costly mistakes.

Other Hidden Costs in Filing Your Taxes

We ask you again, do you really think this is it? Nope, it’s not! Tax filing can become so complicated that you, as a business, may end up paying thousands of dollars more in additional services. Most large corporations with in-house accountants may miss out on important practices, such as:

- Tax Planning: $200 up to $500/hour for customized strategies.

- Audit Support: $500 to $5,000+ depending on case complexity.

- Amended Returns (Form 1040X): Typically between $200-$250.

The result? Improper tax filings with heavy fees and penalties. This is also one of the biggest reasons why paid tax preparers are the first choice of individuals and businesses to file taxes.

The most common method for tax file USA is to use e-filing, which is often included in all average tax preparation fees. Some other methods are paper filing which costs $50 to $100 extra, and expedited filings which are done under 72 hours and can cost you roughly 20% to 50% more.

Other minor factors also increase the costs of tax filings. If your tax preparer will need ongoing training for things like the Inflation Reduction Act by the IRS, expect to get added fees. Also, if you want to file tax in multiple states, consider between $30 to $50 per state return costs. Finally, in the end (which it is not you will find out), tax software, such as TurboTax, and H&R Block will cost you nothing to $120. Although, this guided software can be confusing for a citizen or taxpayer to unpack alone.

Tax Prep Fees vs. IRS Penalties: What Would You Rather Pay?

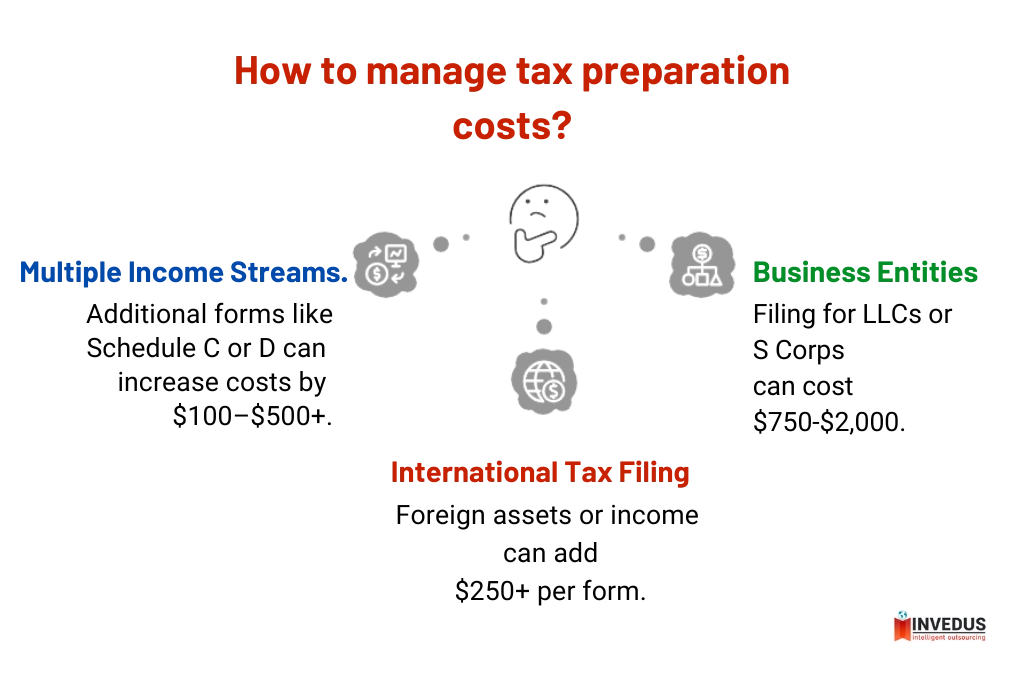

According to many upcoming trends, tax preparers’ fees and their numbers have risen by 0.5%. But more statistics say tax filing isn’t likely to slow down at all as mentioned in the chart below.

E-filing done by professional tax preparers is still dominating the numbers. Also, other data suggests E-filing was the most common way for filing tax returns in 2024, with over 93% use rate.

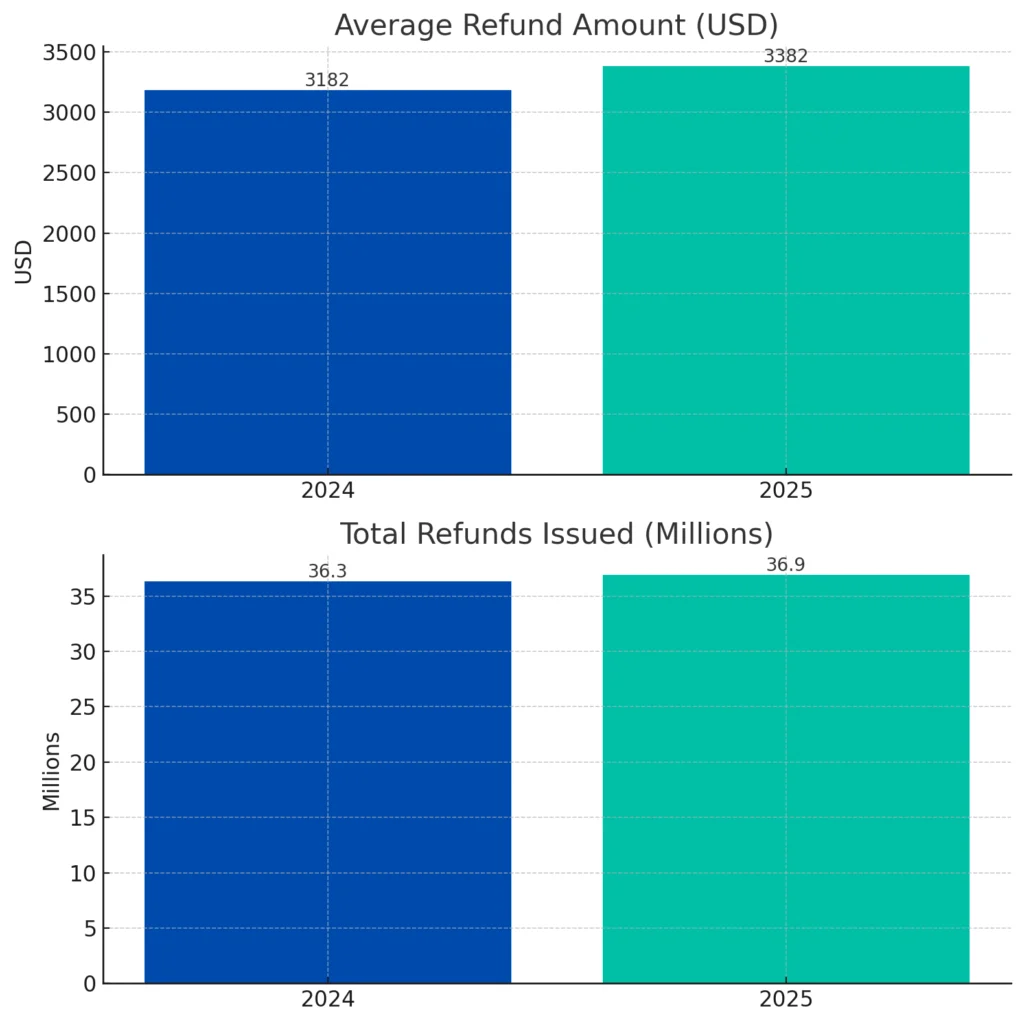

Also, if you were interested to know how much returns taxpayers received for the years 2024 and 2025, here is the chart for the same:

These trends give a clear picture to many about how tax filing is of the utmost importance and how individuals and businesses are quick to file them on time. Though rare, the IRS can charge you a hefty fee on late tax filing and late penalty fee payment. The below table explains in great detail the fees and penalties related to taxes in the US:

| Category | Penalty Type | Details | Maximum Penalty Charged |

|---|---|---|---|

| Individuals | Failure to File | 5% of unpaid tax per month late | Up to 25% of unpaid tax |

| Failure to Pay | 0.5% of unpaid tax per month late | Up to 25% | |

| Both Filing & Paying Late | Combined penalty = 5% total per month (4.5% filing + 0.5% payment) | Filing penalty maxes out first | |

| Minimum Penalty | If more than 60 days late, lesser of $485 or 100% of unpaid tax (2024) | $485 or tax amount | |

| Businesses (Corporations) | Failure to File | 5% per month on unpaid tax | Up to 25% |

| Failure to Pay | 0.5% per month on unpaid tax | Up to 25% | |

| Partnerships & S Corps | $245/month per partner/shareholder (2024) if return is late | No clear max; depends on size & months | |

| Payroll Taxes | Deposit Penalty | 2%-15% based on delay in depositing payroll taxes | Up to 15% |

| Accuracy-Related Penalty | Underpayment / Negligence | 20% of underpaid tax due to negligence or disregard of rules | 20% |

| Fraudulent Filing | Civil Fraud Penalty | 75% of tax underpayment due to fraud | 75% of underpaid amount |

Disclaimer: This information has been written in reference to the IRS’s policies on penalties, Failure to File Penalty and Failure to Pay Penalty. Please do your own research before making any financial decisions.

These are called costly mistakes. Not only as a business can you go under completely, but as an individual it can mean half your salary. So, it is a choice that many millions of Americans might face. Do you want to choose the fees and penalties or do you want to pay less in average tax preparation fees? You can finalize your answer after reading the next section.

The Average Fee for Tax Preparation Charged in the U.S.

At first, tax preparers seem very expensive. After all, they are financial experts who are assisting you in filing your taxes error-free and compliant. However, if you outsource tax filing from Invedus, at $799/month you can get done with your taxes ahead of time. Our tax preparer experts will also walk you through each of the costs, so you get better returns and spend minimal fees on tax preparers.

In short, as an entity, you will be bothered with filing a small number of forms, such as:

| Entity Type | Form/Schedule | Average Cost (USD) | Key Cost Aspects |

|---|---|---|---|

| Individual | Form 1040 (Basic) | $150–$300 | Itemized deductions (Schedule A: +$30–$100)Capital gains (Schedule D: +$50–$75)State returns (+$30–$50) |

| Sole Proprietor | Form 1040 + Schedule C | $300–$500 | Self-employment incomeHome office deductionsEstimated quarterly taxes |

| Partnership | Form 1065 + K-1s | $733–$900 | Multi-member ownershipProfit/loss allocationState partnership filings |

| S Corporation | Form 1120S + K-1s | $800–$950 | Payroll complianceShareholder distributionsFringe benefit reporting |

| C Corporation | Form 1120 | $800–$1,200+ | Double taxation (corporate + shareholder)Complex deductionsMulti-state operations |

| Trade/Barter | Form 1040 + Schedule C (reported as income) | $350–$600+ | Valuation of traded goods/servicesSales tax on barter transactionsIRS scrutiny |

These forms are the first ones you should fill out or urge your tax preparer to help you file right away. But, if you are an individual business owner or solopreneur, your forms will vary. Here are more forms you will have to fill out during tax season as a business, individual, or any other entity:

| Forms/Schedule | Purpose | Average Cost (USD) |

|---|---|---|

| Form 1040 | Individual Income Tax Return (basic, not itemized) | $190–$220 |

| Form 1040 (Itemized) | Individual Return with Itemized Deductions (Schedule A) | $220–$323 |

| Schedule A | Itemized Deductions | $30 |

| Schedule B | Interest & Ordinary Dividends | $5 (each) |

| Schedule C | Profit or Loss from Business (Self-Employed) | $192–$200 |

| Schedule D | Capital Gains and Losses | $50–$75 |

| Schedule E | Supplemental Income (Rental, Partnership, S Corp) | $130–$145 |

| Schedule EIC | Earned Income Credit | $65–$100 |

| Schedule F | Profit or Loss from Farming | $200 |

| Schedule SE | Self-Employment Tax | $20 |

| Form 940 | Federal Unemployment Tax Return | $78 |

| Form 941 | Employer’s Quarterly Federal Tax Return | $111.95 (hourly avg) |

| Form 1065 | Partnership Return | $733–$900 (avg), $759 LA |

| Form 1120 | Corporation Income Tax Return | $800–$950 (minimum) |

| Form 1120S | S Corporation Return | $800–$950 (minimum) |

| Form 1041 | Fiduciary (Estate/Trust) Return | $500–$576 |

| Form 709 | Gift Tax Return | $421 |

| Form 990 | Tax Exempt Organization Return | $800–$900 (minimum) |

| Form 4506-T | Request for Transcript of Tax Return | Typically included/free |

| Form W-2 | Wage and Tax Statement (for employees) | Typically included/free |

| Form W-9 | Request for Taxpayer Identification Number | Typically included/free |

| Form 2848 | Power of Attorney and Declaration of Representative | $50–$100 (varies) |

| Form 8863 | Education Credits | $30 |

| Form 8829 | Expenses for Business Use of Home | $40 |

| Form 8960 | Net Investment Income Tax | $25 |

| Form 8949 | Sales and Other Dispositions of Capital Assets | $5 (each) |

Due to the lengthy process taking at least 3 to 10 days, tax preparers might charge you depending on that. We have already discussed the factors that can inflate the price so this breakdown is just a transparent cost list for you to get an average of how much you will have to pay.

What Is The Total Cost of Filing Your Taxes Through Professionals?

Obviously, you can find that out by adding all the values that apply in your case from the above-mentioned cost-estimation tables. But, that is not the only way you can calculate costs. If we go by the values mentioned above, this is the total that presents itself for the tax average rate of professionals:

- Simple Individual: $150–$220

- Itemized Individual: $261–$323

- Sole Proprietor: $300–$500

- Partnership (1065): $590–$900

- S-Corp (1120S): $761–$950

- C-Corp (1120): $806–$1,200

If you don’t want a range but actual estimation to go off of, there is a smarter way to do so. We recommend that you create an Excel sheet to calculate costs of different tax preparers in the U.S.

First, create the following cells in your Excel sheet:

| Input | Example Cell | Description |

|---|---|---|

| Base Fee | B2 | Main fee for your tax return type |

| Number of Forms | B3 | Total number of extra forms/schedules |

| Cost per Form | B4 | Average cost per additional form |

| Hourly Rate | B5 | Preparer’s hourly rate (if applicable) |

| Extra Hours Needed | B6 | Additional hours for complex cases |

| Surcharges | B7 | Any extra fees (rush, audit, state, etc.) |

With the above example, your “total” cell will be B8. Now, you can calculate the sum by using the following equation:

=B2 + (B3*B4) + (B5*B6) + B7

You can call tax preparers or agencies and gather the charge for each aspect mentioned. After that, you can enter them in your Excel sheet to automate the total charge each average tax preparer costs for taxes.

This will help you to always work with cost-effective, professional, and knowledgeable tax advisors in the USA.

Where Can You Find Reliable Tax Accountants?

If you are still thinking how much does it cost to file taxes, we recommend reading the guide again. We did a breakdown of every possible aspect of a tax filing that can help you find the average cost of tax preparation for individual.

The best way to find the tax preparer who will help you file your taxes without any mistakes or hidden additional charges, you should contact Invedus.

At Invedus, we offer tax preparation professionals who can help you close your deadline for tax filings on time. These are trained and certified virtual assistants who can help you with:

- Organizing financial documents

- Preparing and reviewing tax forms

- Filing taxes accurately and on time

- Communicating with tax authorities

- Staying compliant with IRS regulations

- Managing last-minute or complex filings

Our professionals are GAAP and IFRS standards. Our professionals are also well-versed with international standards such as IRS (US) guidelines and HMRC (UK) rules.

Want to start by getting a tax expert for your daily taxation needs? Connect with Invedus Now!