As the accounting industry unwinds, many CPA firms explore outsourcing to streamline operations, reduce costs, and access specialized expertise. However, outsourcing also introduces many new risks that need to be carefully managed.

This article highlights key risk management strategies for CPA firms considering or already availing of outsourcing services.

Furthermore, the strategies and best practices that CPA firms can employ to reduce the risks associated with hiring outside accounting talent.

Ignore the technical details and allow us to guide you through the measures we have taken to ensure a secure and fruitful outsourcing process.

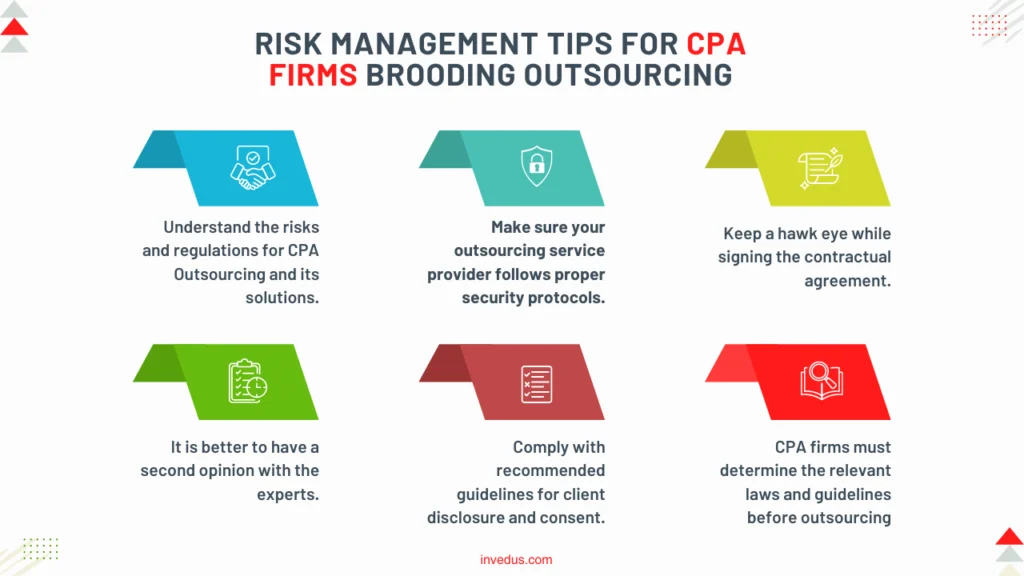

1. Understand the risks and regulations for CPA Outsourcing and its solutions.

You must be aware of the possible risks that your company may face when outsourcing accounting functions before you can implement risk management strategies. These risks consist of, and how to counterfeit from all these risks:

A) Sharing confidentiality and data security can increase the odds.

When you decide to outsource your accounting functions, you’ll need to share sensitive financial information with your third-party service provider. This raises concerns about illegal access, breached confidentiality, and data violations.

However, if you choose a trustworthy outsourcing provider, you will not have to worry about data breaches or unauthorized access.

B) Often, you have to make trade-offs between financial data accuracy and quality.

The risk of mistakes, inconsistencies, and poor work arises when important accounting tasks are outsourced; this can affect financial reporting and compliance.

That being said, a capable outsourcing supplier ensures to offer their clients the best financial services.

Worth reading: Why CPA Firms Should Consider Outsourcing Financial Statement Preparation

C) Conflicts with your outsourcing partner’s communication and teamwork will inevitably arise for your CPA firm.

A lack of communication and coordination between your CPA firm and outsourcing provider can lead to misunderstandings, delays, and a lack of alignment in objectives and expectations. which frequently results in a decline in the client relationship.

However, if you would rather outsource your financial tasks to India, you can avoid poor communication and collaboration issues because India is the country where English is spoken the second most frequently, which can help to prevent many communication issues and even stop project delays.

D) Compliance and Regulatory Risks

Failure to adhere to accounting regulations and statutory requirements can lead to severe consequences. Legal repercussions, including fines and penalties, are a direct outcome.

Reputational damage can be extensive, eroding trust among clients, investors, and other stakeholders. This loss of trust will negatively impact your business operation and financial performance.

Additionally, non-compliance will result in operational disruptions and increase project costs due to investigations and corrective actions.

Outsourcing financial tasks to Invedus experts can help mitigate these risks by ensuring compliance, reducing errors, and leveraging specialized knowledge.

Since Invedus has a wealth of financial experts who are well-versed in both accounting standards and regulatory requirements, compliance can be assured.

They are well-versed in handling tasks such as financial reporting, tax preparation, and audits, reducing the likelihood of errors and omissions.

2. Make sure your outsourcing service provider follows proper security protocols.

Since CPA firms are solely in charge of protecting the data of their clients, they must ensure that any third-party service provider has adequate data security protocols and safeguards in place.

Whether they are offering onsite or remote personnel doesn’t matter, these third-party service providers must be equipped with the advanced tools and technologies that can protect clients’ confidential information against external and internal risks.

To prevent breaches, businesses must assess the appropriateness and objectivity of the entity’s network as well as its administrative, physical, and security measures.

Assessing whether the entity’s security measures are adequate to stop potential abuse or unauthorized disclosure of private information (such as improper access to, use of, downloading, printing, scanning, or copying of client information) is one way to ensure that the data and privacy laws, professional standards, and the terms of your contract are all followed.

There should be a contractual agreement between you and a third-party service provider that clearly defines the responsibility of the outsourcing firm to maintain the security and confidentiality of client information.

3. Keep a hawk eye while signing the contractual agreement.

Make sure the service provider is in complete agreement with your terms and conditions before you sign a contract with the outsourcing company. Additionally, if you are the owner of a CPA firm and are unable to agree on the terms, you must have the option to decline the outsourcing option.

The specifics of the contract should be carefully considered to make sure that outsourcing arrangements do not compromise the company’s capacity to uphold high standards of care.

Companies should also make sure that their agreements do not conflict with any applicable insurance policies.

4. It is better to have a second opinion with the experts.

Before signing agreements or contracts containing language related to governing law, indemnity, and harmless clauses, firms should think about speaking with an attorney in their respective states if they have any questions about the effectiveness and potential risks to their firms.

To properly address security measures and safeguards for the transmission of confidential client information, consulting with IT professionals may also be necessary.

5. Comply with recommended guidelines for client disclosure and consent.

It is suggestable that CPA firms must disclose the use of outsourcing services to their clients. Provide your client with the option to opt-out if they so choose, or proceed with the third-party service provider if they wish to.

Being honest upfront with a client is preferable to having to deal with an irate one later.

In addition, CPAs’ engagement letters ought to constantly contain a disclosure about third-party service providers. This proactive strategy will shield you from criticism and lessen your potential exposure to liability should any damages occur.

6. CPA firms must determine the relevant laws and guidelines before outsourcing

Ensuring the firm can meet the legal, professional, and regulatory standards of outsourcing is imperative and requires taking this crucial step. Among the laws and guidelines that may be used are the following:

a) AICPA’s Code of Conduct

According to the ethics guidelines of the AICPA, members are accountable for all work that is contracted out to outside service providers. Firms must oversee these professional services and bear overall responsibility for ensuring that all professional services are rendered with appropriate professional care and professionalism.

b) Internal Revenue Code (IRS)

CPAs are required to obtain explicit written consent from taxpayers before disclosing or using their tax return information under IRC §7216. This includes any disclosure or use that goes beyond the scope of tax preparation services.

The IRS has specific regulations in place to protect the confidentiality of tax return information, especially when it involves disclosures outside the United States. Failure to comply with IRC §7216 can result in serious legal consequences, as it is a federal criminal provision.

An IRS investigation into non-compliance with §7216 disclosure and consent requirements will likely be treated as a criminal matter, potentially leading to fines, penalties, or even imprisonment.

That’s why CPAS needs to adhere strictly to the requirements of IRC §7216 to safeguard their clients’ privacy and avoid legal repercussions.

c) Gramm Leach Bliley Act (GLBA) / Federal Trade Commission (FTC)

CPAs are obligated by the Federal Trade Commission (FTC) to oversee the use of client information by third-party service providers they engage with. This responsibility ensures that these providers adhere to the GrammLeachBliley Act (GLBA), a federal law protecting consumer financial information’s privacy.

CPAs must take reasonable measures to choose and hire a third-party service provider that has appropriate security measures in place to protect client data in order to meet their obligations.

These measures should be commensurate with the sensitivity of the information being handled. Additional CPAs must have contractual agreements with these outsourcing providers that explicitly mandate their adherence to data protection standards.

These contracts ought to specify the precise security measures that the suppliers must implement and uphold.

By taking these proactive steps, CPAs can effectively mitigate the risks associated with outsourcing and ensure the protection of their clients’ sensitive financial information.

d) State Board of Accountancy

CPAs should check with the state boards of accountancy in their respective states to find out what regulations apply to client disclosure.

Certain states, like California, for instance, may forbid outsourcing without the client’s consent and demand written disclosure and consent when the outsourcing is done outside of the country.

e) Other aspects Need to be Considered

Companies may need to review non-disclosure/confidentiality agreements they have signed with current clients to make sure the company is not in violation of any clauses.

The U.S. Securities and Exchange Commission, the U.S. Department of Labor, and other regulatory bodies may have disclosure and consent guidelines that should be reviewed for compliance depending on the particular industries and/or services the firm specializes in.

Closing Off

Undoubtedly, outsourcing accounting has loaded with many benefits, but it has come with so many risks too. As a CPA firm owner, you can steer the outsourcing landscape more confidently and reduce potential risks if you have a good outsourcing partner.

Prioritizing risk management is essential for CPA firm owners who want to safeguard their brand, uphold client confidence, and succeed in the long run when it comes to hiring accounting talent from outside sources.

If you are also one of them, who does not have enough time to indulge in these laws but wants to outsource without any hassle. Look, Invedus, we have been serving our services to CPA firms, SMEs especially to all English-speaking countries, for the last 10+ years by adhering to all the laws.

Our financial specialists are aware of your laws and make sure you follow all applicable guidelines so that you can establish a solid rapport with us.

To give us a chance, fill out the form and outsource your financial tasks error-free.