Construction accounting is a specialized form of accounting that emphasizes the financial management and reporting of construction projects. These companies often need to make crucial decisions as they have limited financial alternatives. For instance, bidding for the projects, and choosing materials and equipment for every project. Additionally, the items you choose will keep all of this cash flow positive.

It is very challenging for construction companies to remain in the plus cash flow loop. As they have to face many challenges, such as delayed payments, and high failure rates in construction projects, each project asks for different requirements and more.

This is where accounting for construction comes into play. This blog post will provide you with in-depth knowledge about construction accounting and explain how it can help you stay profitable even after facing numerous challenges.

What is Construction Accounting?

Accounting for construction is a specialized form of accounting that focuses on the financial management and reporting of construction projects. It’s designed to address the unique challenges of construction projects, such as long timelines, complex costs, and contractual obligations.

Construction accounting helps contractors track costs across multiple projects, record profits, and monitor each job from start to finish. It can also help ensure compliance with industry regulations and provide valuable insights for decision-making.

Further, this accounting shares many principles with other forms of project accounting, but it also includes some key differences. For example, construction accounting must consider project-specific financial data, such as:

- Progress payments

- Retainage

- Change orders

- Fixed price billing

- Time and material

- Unit price

Construction accounting also involves tracking and analyzing costs, managing budgets, and monitoring cash flow. When recording information, it’s important to include key details such as transaction dates, amounts, descriptions, and account numbers. Accounting software and apps can help keep separate bookkeeping journals for different accounts.

Methods Used in Accounting for Construction

Use the below accounting method to handle your construction company’s tax deferrals

1. Cash Accounting

It is one of the simplest and most direct accounting approaches to monitoring finances. Under cash-based accounting, construction company revenues are recognized when payment is received, and expenses are recognized when bills are paid.

This method is perfectly suited for small businesses, as profit calculation is simple since profit is just cash received minus cash disbursed.

Why Cash Accounting for Construction

- Businesses record revenue when payments are received, not when billed.

- It is perfectly suited for smaller construction companies legally under IRS tax laws.

- This approach is incredibly simple to comprehend and use because it simply relies on the amounts shown on the register when cash comes in or goes out.

Disadvantages of Cash Accounting

- Incompatible with other billing methods, such as Percentage of Completion.

- It is less accurate with the month-end and forecasting.

- Cash accounting needs to take account receivables and payables into consideration, it provides businesses with a limited understanding of their future cash flow.

2. Accrual Accounting

This accounting method records expenses when they are incurred but not always paid for, and revenue is recognized as work is completed rather than when cash is received.

The accrual method records revenues and expenses as soon as bills are sent and received.

For example, the construction company completed its share of the work in June and sent the bill to the other party; this is regarded as the company’s revenue. On the other hand, the other party who has received the bill from the vendor or supplier of that construction company is considered to be at the expense of the second party.

Notably, the payment doesn’t need to have been made in both situations.

Why Accrual Accounting for Construction

- Accrual accounting tracks payments in and out as soon as the bill is received, providing a true picture of the company’s current financial status.

- With improved insights into their business’s present and future health, construction companies can continue to reap benefits.

- A clear summary of the entire workload and the current workload.

Disadvantages of Accrual Accounting

- Accounting teams use the Work in Progress (WIP) report from the field extensively to reconcile monthly invoices and expenses.

- Before any revenue or expense is settled permanently, businesses must make numerous adjustments to the numbers between columns to track funds coming in and going out of the company.

- Accounting teams generate late invoices to settle the bills owed for labor and materials.

3. Percentage of Completion Method

The Percentage of Completion Method (POC) is an accounting technique used for long-term projects. It recognizes revenue and expenses based on the percentage of work finished during a specific period. In simpler terms, consider getting paid based on how much you’ve completed a project, rather than waiting until the entire thing is done.

The PoC method helps companies align their recorded revenues with their incurred expenses, and it can help financial statements accurately reflect revenues and expenditures during periods when projects are ongoing. It can also be a more accurate representation of the revenue earned.

How to Calculate the Percentage of Completion Method

To calculate the percentage of completion, you can use the following formulas:

- Percent complete: Total costs to date ÷ total estimated costs

- Revenue recognized: Percent complete x contract amount

For example, if a contractor has built 80 homes out of a total of 200 for a client, they can calculate the percentage of completion by dividing 80 by 200 and multiplying the result by 100, which would give them a percentage of completion of 40%

Why Percentage of Completion Method for Construction

- The POC method recognizes revenue and expenses as the project progresses, giving a more accurate picture of the project’s financial health at any given time.

- Companies can receive revenue throughout the project, which will assist in balancing cash flow management.

- You can gauge project profitability throughout its lifecycle, allowing for better decision-making.

Disadvantages of Percentage of Completion Method Accounting

- Fluctuating income and revenue recognition can vary significantly between accounting periods, making forecasting challenging.

- Calculating percentages of completion and making journal entries can be more complex compared to simpler methods.

4. The completed contract method (CCM)

Another branch of accounting known as CCM comes from the accrual method. Revenues and expenses are recorded using this method at the time the sale is closed.

This approach is best suited for large construction firms that work on longer-term projects that cover several accounting periods.

The completed contract method typically uses monthly accounting periods, with month-end closing and cost and revenue recognition.

Due to the uncertainty surrounding the sale price until the project is finished, homebuilders and speculative developers are the main users of this CCM accounting.

Let’s understand this method by example.

Renovating a Kitchen (Completed Contract Method)

Imagine a construction company signs a contract to renovate a kitchen for $20,000. The project involves both direct and indirect costs:

Direct Costs: These are easily traceable to the specific kitchen project. Examples include:

- Lumber: $2,500

- Cabinets: $5,000

- Appliances: $3,000

Labor directly assigned to the kitchen project: $6,000

Indirect Costs: These are not directly attributable to a single project but are necessary for overall operations. They are allocated to projects based on an estimation method. Examples include:

- Salaries for office staff: $1,000 (allocated portion)

- Utilities for the company workshop: $500 (allocated portion)

- Depreciation of company vehicles: $250 (allocated portion)

Using the Completed Contract Method:

Work in Progress (WIP) Inventory: Throughout the renovation, all costs (direct and indirect) are accumulated in a WIP inventory account. So, the WIP would increase by:

- Direct costs: $2,500 + $5,000 + $3,000 + $6,000 = $16,500

- Indirect costs: $1,000 + $500 + $250 = $1,750 (allocated for this project)

- Total WIP increase: $16,500 + $1,750 = $18,250

Completed Project: Once the renovation is finished, the kitchen is considered part of the company’s inventory.

Revenue Recognition: When the client pays the $20,000 contract amount, it’s recorded as revenue.

Cost of Goods Sold (COGS): The total cost of the project (WIP balance) is removed from the WIP account and recorded as the Cost of Goods Sold (COGS). This reflects the actual cost of completing the kitchen.

Profit Calculation: By subtracting the COGS ($18,250) from the revenue ($20,000), we get the gross profit on the project: $20,000 – $18,250 = $1,750.

Why Completed Contract Method for Construction

- Delaying the recognition of revenue and costs allows the Completed Contract Method to streamline accounting during the project.

- Reduced administrative load throughout the project.

Disadvantages of Completed Contract Method Accounting

- At the time of the revenue realization, uncertainty may arise.

- It is difficult to assess project profitability in real-time.

- If anyone uses the completed contract method accounting, there is a good chance that future liability may increase if tax laws change.

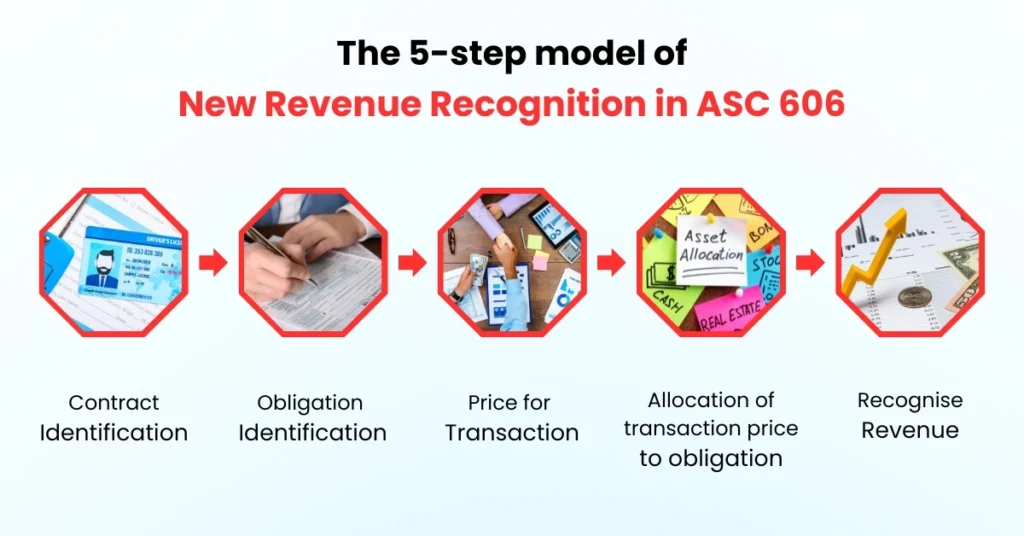

5. ASC 606 New Revenue Recognition Standards

Having said that, a new regulation came into effect. The Financial Accounting Standards Board (FASB), which oversees generally accepted accounting principles (GAAP) in the US, has released new guidelines for revenue recognition. The guidelines are titled “ASC 606: Revenue from Contracts with Customers.”

GAAP offers the best accounting standards across all U.S. industries. Nearly all US companies reporting under GAAP as of December 2018 are required to follow ASC 606. Furthermore, many private businesses opt to adhere to GAAP’s recommended practices even though they are not legally required to do so.

These standards assist contractors in determining, among other areas of guidance, whether they should record revenue on their books continuously (as with PCM) or only once (as with CCM). However, in the case of ASC 606, the issue revolves around transferring control.

Under ASC 606, control is transferred to customers when they own their property. For example, if the property is located on the customer’s land, they may be in charge of the frame, foundation, and other structural elements from the moment the concrete is poured. In a project involving complete development, control transfer might not occur until the contractor gives you the keys.

However, as it is a contractual requirement, the parties have to agree in advance when control is transferred, either all at once or gradually, to account for income appropriately.

Contractors must adhere to a host of other significant requirements outlined in the ASC 606 rule. This includes figuring out how to calculate the contract price, divide the sales, and decide whether to count a project as one contract or several contracts. Changes to contract losses, stored materials, and cost-to-cost computations must also be made in the accounting.

To ensure they are on the right track, contractors should speak with their construction accountant, just like they would when using cash accounting or techniques like PCM and CCM.

Worth Reading: Outsourced Accounting for Startups and Small Business

Best Construction Accounting Software

1. Zoho Books: Automate Financial Statements

This accounting software caters specifically to the construction industry. It helps manage finances, track income and expenses, and stay compliant with relevant tax regulations.

2. Xero: Small Business Preferred

Xero software is widely used for construction accounting. It offers a variety of features that are helpful for construction companies, including project tracking, invoicing, expense claims, reporting, and many more. Also, you can manage all these jobs using your mobile device.

3. QuickBooks: Best Invoicing for Construction Businesses

This useful accounting software for construction businesses allows you to enjoy multiple features with its Desktop Premier and Enterprise versions.

You can perform multiple tasks alike:

- Job costing: This helps you track the profitability of individual jobs by following the expenses and income associated with each project.

- Progress billing: You can create invoices based on the percentage of work completed on a job.

- Manage subcontractors: Easily track subcontractor costs and send 1099s at tax time.

- Customizable reports: Generate reports that provide insights into your construction business, such as job profitability, project budgets, and cash flow.

4. Sage 300: Construction and Real Estate Management Software

With the help of this financial management solution, you can oversee your building project or property accounting lifecycle. This real estate accounting software facilitates the precise and assured construction and upkeep of projects and properties by contractors, developers, and property managers.

These are just a handful of the accounting software for construction companies available. However, the list is too long to check every single piece of construction accounting software. Therefore, choose the accounting software for your construction business wisely.

Also Read: Top Accounting Software for Property Management in 2025

Help Section

Q1. Are construction accounting and regular accounting the same?

A1. Construction accounting is a specialized field within regular accounting, catering to the unique needs of the construction industry with its long-term projects, complex cost structures, and progress-based billing.

Q2. What are the alternatives of construction accounting I have, if I don’t want to go with the software and onsite accounting team.

A2. If you own a construction company

- You can hire a virtual accountant for your construction business.

- You can outsource your construction accounting services.

- You can set up an offshore accounting office.

Q3. Can construction accounting outsourcing help me if I am a newbie to the construction market?

A3. Yes, it is one of the best pocket-friendly options you have. It doesn’t matter whether you are a startup, small, or mid-sized business outsourcing fits in all business.

Q4. What kind of tasks do outsourcing accounting firms do to promote my construction business?

A4. Outsourcing accounting firms can manage your payroll, bookkeeping, accounting, tax preparation, finance management, payroll, and all else your business requires.

Q5. Do, I need to hire a full-time accountant for the construction business?

A5. Well, the choice is completely yours, you can hire a full-time construction accountant or a fractional CFO according to your business needs.

Boost your construction finance efficiency with Invedus Outsourcing. Choose from our Virtual Employee Models: Single Hiring, Team Hiring, and Staff Automation, tailored to meet your needs. Fill out this form here to get started.