Looking to Outsource Your AML Requirements? Read This!

Organizations need to create improved anti-money laundering (AML) programs because financial crimes have risen while regulations like the Bank Secrecy Act (BSA) have made the landscape more complex.

However, as financial criminals use sophisticated methods to attack the defenses set up by financial institutions, in-house teams are stretched too thin to handle AML compliance. As the ever-increasing operational costs and the shortage of skilled compliance officers add to this mix, it becomes challenging to establish AML compliance programs.

As it becomes increasingly complex to manage AML requirements effectively, most organizations are considering outsourcing their AML requirements. The burgeoning gaps in the transaction monitoring process, along with the growing issues with beneficial ownership, are the driving factors behind this change. There has also been a shift in the way banks and other financial institutions approach outsourcing when it comes to anti-money laundering programs.

BSA/AML compliance outsourcing is much beyond reporting suspicious transactions and conducting ongoing customer due diligence. It is no longer a simple cost-reduction exercise but a financial intelligence unit that has morphed into a strategic capability enabler.

Prevailing Problems in Traditional AML Programs

Traditional in-house anti-money laundering (AML) programs were made for predictable transaction volumes and simple workflows. Now, they’ve reached their limit, and the fixed staffing models don’t keep up with AML program requirements. The problem here is that while it takes a considerably longer amount of time to find and train experienced analysts, financial institutions must respond to regulatory changes or volume spikes instantly.

What’s worse, the compliance-related workload is just exponentially rising. The time and effort examiners spend on compliance rose by 61% while their total working hours barely rose by 20%. These numbers clearly showcase the strain on operational metrics. For instance, unresolved alerts pile up due to capacity constraints rather than weak internal controls.

To combat money laundering, financial institutions need to establish AML programs with appropriate risk-based procedures, such as third-party risk management. AML obligations require financial institutions to transition to a more adaptable and scalable model, like outsourcing their compliance efforts to strengthen governance.

Advantages of Outsourcing AML Compliance Activities

Financial institutions need to outsource their AML operations to specialized providers because they encounter two primary challenges: their accumulating alert backlog and increasing regulatory penalty exposure. The strategic change enables institutions to use their dedicated partner’s specialized knowledge, advanced technology, and broad capabilities for executing Financial Crimes Enforcement Network-defined requirements.

The first advantage of outsourcing is its ability to reduce operational costs. By hiring a managed services provider, you can make your operational expenses more predictable and transparent. Research shows that 88% business leaders across the world support outsourcing key operational activities to managed services as they offer cost-effective operational solutions.

Outsourcing enables institutions to access experts who possess specialized skills. Managed service providers maintain teams of experienced AML professionals who bring advanced expertise about current regulatory standards, risk identification methods, and compliance systems. This approach helps enhance your internal workforce through expert capabilities, without investing heavily in new employee training and hiring processes.

The leading AML outsourcing providers have dedicated substantial resources to acquiring top AML compliance platforms that use artificial intelligence, machine learning, and advanced analytics. These tools improve threat detection accuracy and provide full customer risk assessment solutions to help institutions stay ahead amidst emerging security threats.

When and How to Choose Outsourcing

Every institution should evaluate its unique business requirements, operational strengths, and operational objectives to determine if an AML outsourcing strategy makes sense. Here are some glaring indicators that depict the necessity of outsourcing AML compliance.

- Your team faces ongoing difficulties in following new regulations,

- Your alert/investigation workload continues to grow more complex,

- You’re relying on outdated/siloed compliant infrastructure

All of these aspects can hinder your team’s ability to combat terrorist financing effectively. However, evaluating AML outsourcing service providers goes beyond a deeper understanding of their pricing structure.

An ideal compliance partner must possess domain know-how and have a proven track record of fulfilling regulatory obligations. Your institution needs to evaluate the MSP’s technical abilities, data protection systems, and capacity to handle rising workload during institutional growth. Even if you outsource your AML process, your institution will still be primarily responsible for achieving compliance.

So, it is crucial to take control of your compliance standards by establishing direct communication paths with the service provider. It would also be beneficial to build an effective governance system to ensure your outsourcing partner upholds the same compliance standards as your internal compliance department.

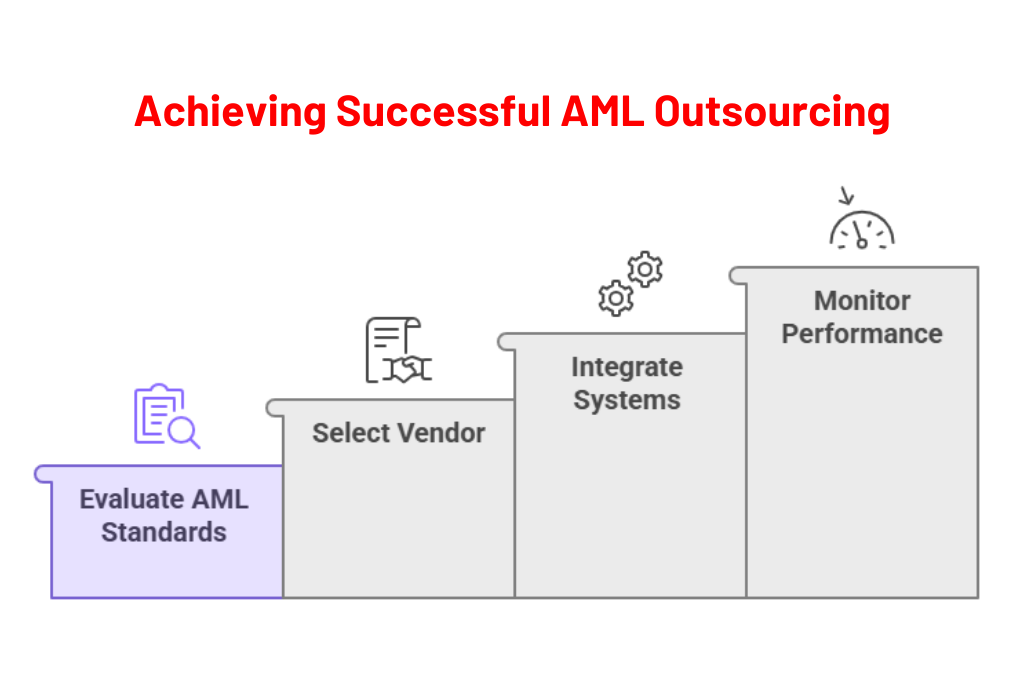

The Key to Successful AML Outsourcing

The process of outsourcing AML operations requires a strategic, multi-step implementation plan for an efficient and successful transition. The most important factor is that adequate governance oversight must be woven throughout all its stages.

- You can begin by conducting a thorough evaluation of the existing AML standards. This will help spot weaknesses, identify and shortlist processes for outsourcing, and come up with SMART performance indicators. This forms the baseline against which the performance of the outsourcing relationship will be measured.

- The vendor selection process requires a thorough evaluation of candidates who meet all requirements defined in your third-party risk management and vendor due diligence framework. Each provider will be assessed based on their operational capabilities, business longevity, and compliance adherence history.

- The next phase focuses primarily on the technical and operational aspects, such as data migration, seamless system integration, and combined workflow management. The in-house team needs to maintain continuous communication with provider teams because this will help them ensure service continuity.

- Continuous monitoring marks the end of transition processes. It is all about setting up a performance management system that tracks ongoing performance, collects all KPI-related information, and schedules evaluations to assess both provider operational performance and all suspicious activity reports.

Tips to Strengthen Your AML Compliance

When you use your in-house team or work with an MSP, the technology being used will determine how well your compliance program functions. Modern AML solutions perform automated tasks that improve risk detection precision and deliver complete threat assessment capabilities.

These automated tools enhance operational performance and decrease compliance team workloads . An ideal AML compliance software should automate customer screening, transaction monitoring, and alert generation, enabling your analysts to handle complex, high-risk investigation tasks. It eliminates manual intervention and helps

A modern AML program requires advanced screening functions to serve as its fundamental operational base. These tools enable businesses to perform instant checks of their customers against multiple international sanctions databases, PEP lists, and adverse media records. This allows you to identify high-risk individuals and entities at the point of onboarding and throughout the customer lifecycle.

Multiple advanced platforms exist that institutions can use to access these capabilities. The best AML software includes comprehensive toolsets for continuous screening, as well as AI-powered risk evaluation and case management systems, to enhance compliance efforts and detect threats more effectively.

Make the right choice for your institution

The process of selecting AML function outsourcing now exceeds traditional cost-cutting methods. The solution operates as a strategic method that solves two main problems that stem from internal compliance systems and rising organizational regulatory requirements. A dedicated provider enables institutions to improve their AML program effectiveness through specialized expertise, advanced technology, and scalable capacity.

The organization needs to distribute its resources equally between governance systems and third-party risk management practices to execute this strategic transformation. The institution must take full responsibility for its compliance results because it needs to manage its outsourced operations to fulfill regulatory requirements and fight financial crimes effectively.

Invedus helps financial institutions strengthen their AML compliance through scalable managed services, domain-led expertise, and technology-enabled solutions designed to keep pace with evolving regulatory and financial crime risks.

Last updated on: Jan 30, 2026