Key Differences of Traditional vs Virtual Accountants

As your business grows, so does the need for smart financial management. One of the most important decisions you’ll face is choosing between a traditional accountant and a virtual accounting partner. Each offers unique strengths and knowing which fits your business can drive both savings and scalability.

Traditional accountants use paperwork and huge records to keep track of what your business is doing financially. On the contrary, virtual accountants only need access to your tools to categorize your financial decisions in one place.

So can we say that this is the only difference between in-house accountants and outsourced accounting? If you think yes, we are here to prove you wrong. We will address why virtual accounting wins overall and how you can transition from traditional methods to outsource accounting without much effort.

Key Takeaways:

- Virtual accountants offer flexibility, lower costs, and easy access to real-time financial data, making them ideal for remote and fast-growing businesses.

- Traditional accountants provide hands-on support, in-person collaboration, and local expertise, but they can be more expensive and less scalable.

- Cloud-based tools used by virtual accountants streamline processes, improve accuracy, and allow business owners to access their books anytime, anywhere.

- Security, communication, and compliance are strong on both sides, what differs is how each approach manages them, with virtual services leaning on tech and automation.

- The right choice depends on your business size, budget, preferences, and long-term goals, evaluate what matters most before deciding.

Why Are There Two Types of Accountants?

It seems silly at first as to why there would be two different types of accountants. However, if you understand the differences, it makes sense. An accountant is your financial partner who oversees tasks, such as managing financial records, preparing tax returns, tracking income and expenses, ensuring regulatory compliance, and offering strategic financial advice.

But, this financial partner can be appointed by you or outsourced (provided by a third party provider). These are the only two types generally (apart from freelance accountants).

Who are these individuals though? Let’s learn.

What Is a Traditional Accountant?

Just like the term, traditional accountants usually provide financial services to a company using manual and routine accounting tasks. Some things that make traditional accounting different:

- Recording transactions, bookkeeping, tax filing

- Using manual records, spreadsheets, basic calculators

- Work by reactive nature, historical data analysis

- Creates annual or periodic financial statements

- Their collaboration is limited, mostly with finance and audit teams

- Has strong manual accounting, and tax knowledge

- Ensures adherence to accounting standards and tax laws

When it comes to workplace roles, traditional accountants often work in an isolated manner, only communicating with financial teams. Most old-school accounting experts prefer to do things systematically with resources already available to them rather than demanding system upgradation or similar infrastructure.

What Is a Virtual Accountant?

Virtual accountants are available online and provide financial support anytime, anywhere. Usually, such individuals are capable of handling consecutive tasks as they perform things completely on a system.

Traditional accountants typically operate from a physical office and meet clients face-to-face. In contrast, virtual accountants communicate and collaborate with clients primarily through digital channels such as email, video calls, and accounting platforms.

Virtual accountants work remotely using digital tools like email, video calls, and cloud software. They offer 24/7 access to financial data, serve clients globally, and are often more affordable due to lower overhead and reliance on automated, cloud-based systems.

Key Differences Between Traditional and Virtual Accountants

Differences between traditional vs. virtual accountants are a lot. You can see them as completely polar opposites. There are some factors which you, as a business, can use to compare and find out in house vs outsourcing, which option is good for you.

1. Accessibility and Communication

Communication across a team or individual is too important to ignore. Traditional accounts or in house accounting is quite easy to access and communicate to. They are present on the floor and in the office location during their hours, so it’s easy for you to talk and solve a problem as it arises.

Virtual accountants are less accessible. As their setup is completely online, you can have a 24/7 availability but with some shortcomings. They have their own timezone they function in but that is the advantage as you can expect work delivered while you catch up on your sleep schedule. They use cloud-based platforms and digital tools for communication and document sharing, which is very convenient.

2. Cost-Effectiveness

Costs aren’t a big factor in both cases of accounting. While virtual accountants charge way less than your in house resources, you might still prefer the other due to stability reasons. If you choose account outsourcing, you can save up to 30% to 50%, compared to traditional accountants.

More and more businesses are using telework services to reduce overhead costs. Virtual accountants or outsourced accounting requires no form of employee benefits, making it even more pocket-friendly for small businesses or solopreneurs.

3. Technology Integration

Imagine still maintaining paper records, using local software, and bearing human error. But it is the story that old-school bookkeepers follow. To this day, about 61% of small and medium-sized businesses are still using manual methods of data entry through Excel.

Virtual accountants are completely contradictory and use advanced software, digital tools, and AI automation tools to make sure there is no delay, error, or inaccuracy. Some popular tools are:

- QuickBooks Online (Global Invoicing)

- Xero (Real-Time Financial Data Access)

- FreshBooks (Finance Management for Freelancers)

- Zoho Books (Ecosystem of Zoho Apps for Accurate Tracking)

- 1040SCAN (Tax preparation and Document Management)

- Vic.ai (Automation of Payable Finances with Predictable Insights)

- Slack (Communication Across Organizations and Remote Teams)

- Zoom (Video Chat Platform for Routine Online Meets)

- Google Drive (Sharing, Storage, & Accessibility for All Files)

4. Flexibility and Scalability

When you choose offline accounting services, you are also tying yourself to one physical location and to less flexibility when it comes to timings and costs. However, virtual accounts are much easier to scale, delegate, and communicate with.

You can start by choosing the regions you would like to expand your business to and then hiring local virtual accountants. This will reduce the overall cost of your scalability while also providing you flexibility in time, cost, and scaling up or down.

5. Expertise and Service Range

Accounting is based on hyper-localized services and expertise that thrive on demand. So, even if you decide to hire in house accountants from a region, you will only get access to limited expertise.

Outsourced accounting provides better expertise and a service range you can choose from. Here are some specializations you can expect:

- Sales Tax Compliance

- International Financial Reporting Standards (IFRS)

- Generally Accepted Accounting Principles (GAAP)

- The Dodd-Frank Wall Street Reform and Consumer Protection Act

- The Securities and Exchange Commission (SEC) Regulations

- Sarbanes-Oxley Act (SOX)

- Payroll Tax Compliance

- 1099 and Contractor Reporting

- Anti-Money Laundering (AML) Regulations

- Multi-Currency & Cross-Border Taxation Standards

6. Data Security and Real-Time Access

The biggest risk with outsource accounting services can be data security. But, newer outsourced accountants are following strict data security laws, such as the General Data Protection Regulation (GDPR) by the European Union, the California Consumer Privacy Act (CCPA) from United States (California), the Personal Information Protection and Electronic Documents Act (PIPEDA) standardized in Canada, and ISO/IEC 27001: Information Security Management accepted globally.

Traditional accountants are already compliant as physical offices are precise with their data protection, which makes your business reliant without any worries. Though, physical records can be displaced, so be careful while handling such sensitive older records.

Pros and Cons of Both Types of Accountants

The pros and cons of accounting in house and outsourced are quite different. You can expect the same benefits by choosing either or. However, knowing about the pros and cons of traditional and virtual accountants can help you gauge will option will work for you.

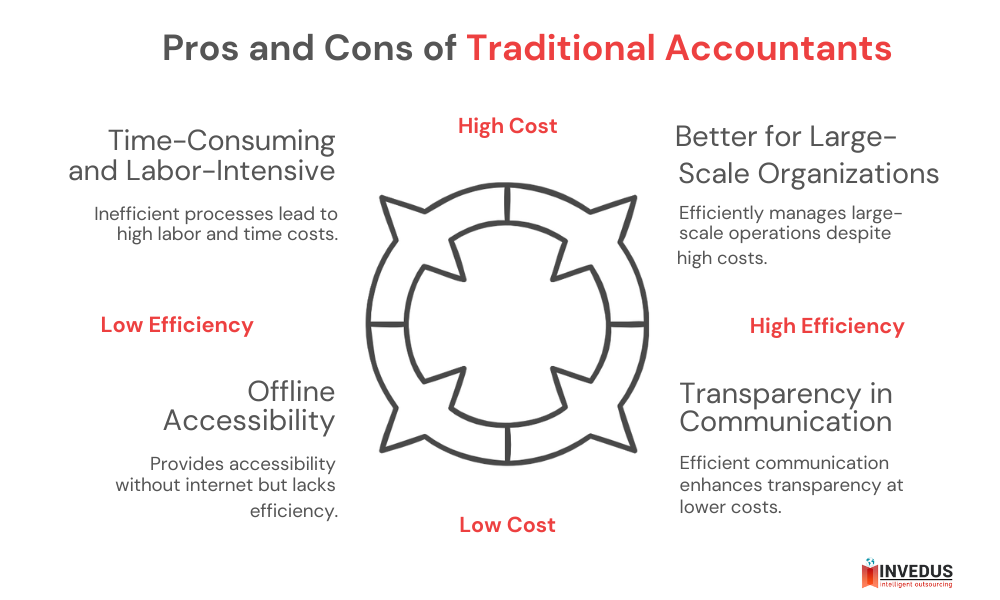

Pros and Cons of Traditional Accountants

Pros of Traditional Accountants

- Offline Accessibility

Needing the internet for every little accounting task is a curse in and of its own. Physical records help with anytime accessibility as you only need access to the right storage area to look at your needful financial papers.

- Full Control and Privacy

You will always have control over what papers and data are stored in your office. This oversight of every little document grants you the control and privacy you need to ensure data safety.

- Transparency in Communication

During any emergency, communication is quite important. Physical offices and on-site staff like accountants are much easier to access for direct communication compared to online available teams.

- Better for Large-Scale Organizations

It can become a great task to handle around 4 trillion paper documents for accounting that are in the U.S. alone and growing by 22% every year. So, online tools may seem more suitable, but traditional accountants use local software or storage systems to manage things better.

Cons of Traditional Accountants:

- Time-Consuming and Labor-Intensive

Manual financial records can be treated as data entry. Keeping up with the manual transition to computer records in the form of simple Excel spreadsheets is also not that easy. It will always require a lot of labor and time to be fully completed without any mistakes.

- Prone to Human Error

Humans are humans because of the mistakes they can make. When manual data entries are common practice, many human mistakes can eventually be spotted which increases work with the need for corrections.

- Higher Operational Costs

Storage, in-house accountants, and overheads all cost a lot. In total, a business may spend around $70,516 to $212,220, including everything. This can be a lot to bear even if it’s yearly.

- Limited Scalability

As your business grows and you make about 50 to 1,000 transactions daily, your old systems may find it difficult to catch up. This is a common problem businesses face with traditional accounting.

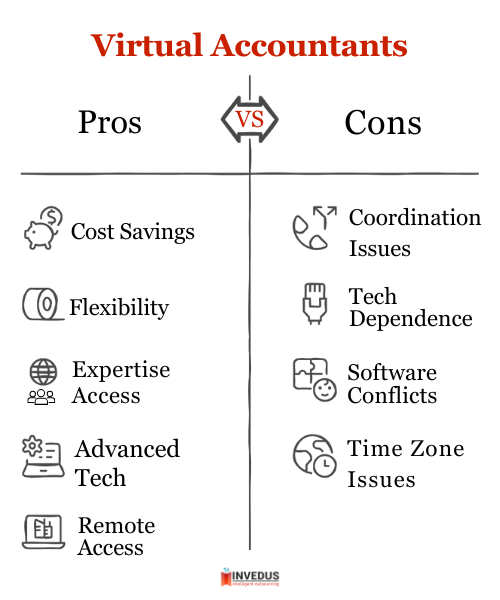

Pros and Cons of Virtual Accountants

Pros of Virtual Accountants:

- Cost Savings

Virtual accountants cost $150 to $900 per month, while traditional accountants can cost $3,000 to $5,000 monthly. There is an 82% to 95% difference in savings with a virtual accountant for bookkeeping compared to other traditional in house accounting.

- Flexibility and Scalability

Accountants outsourced from agencies are quite flexible. They can be onboarded into a project according to the time zones the client prefers. Also, you can select as many accountants as you want or descale when you face stagnancy in your business growth.

- Access to Expertise

As outsourced accounting is far out of the region you reside in, you can hire accounting experts with niche skills. For example, you can choose a good accountant who has expertise in tax law, IFRS, or SEC compliance, or all of them.

- Superior Technology

If you hire local outsourced US accountants, they may use software like Kashoo, AccountingSuite, and Bench Accounting. These are well-integrated software tools that can help you get financial insights, manage documents, and automate certain tasks.

- Remote Access and Convenience

Sometimes you may need to access your financial data from home. Virtual accountants keep track of all your data and can provide access to you instantly, or as you need it.

- Time Savings

There are some routine tasks in accounting, such as bookkeeping, payroll processing, tax preparation, accounts payable and receivable, and monthly financial reporting. All of these can be automated using some above-mentioned tools to save time and labor on daily tasks.

- Improved Efficiency with Automation

Machines rarely make a mistake, it can happen only when humans feed the wrong data. Hence, most tools help with high automation and reducing human errors that are more present in physical financial data management.

Cons of Virtual Accountants:

- Coordination Challenges

Compared to on-site accountants, coordination with remote accounting teams is difficult. You have to entirely depend on communication tools with providing run-through of difficult tasks using video chat tools.

- Dependence on Technology

Virtual means completely delegating all tasks using technological tools and the internet. So if your system faces some breaches, updates, or other tech-related difficulties, tasks will go on hold.

- Proprietary Software Issues

Some companies may prefer working with a particular tool. But your virtual assistant may not be aligned with the same, causing a roadblock in training and tool adjustment before work can even begin.

- Time Zone Differences

Different time zones can be an advantage, though usually it can also be a disadvantage, especially in emergencies. If you need to connect with your virtual accountant right away, you may not be able to.

Traditional Vs. Virtual Accounting: Which One Is Right for You?

To answer this based on your business budget will be a little unjust. Choosing either traditional accounting or virtual accounting fully depends on the use cases. We might not know the exact business structure you have, but based on the following examples, you may be able to determine the best option of accounting for you.

What if I Run a Brick-and-Mortar Retail Store?

Best Fit: Traditional Accounting

If you are based on a physical location and require meeting up with your team everyday, traditional accounting makes more sense. You will be able to manage better and clear up problems as they arise naturally.

If I’m an Owner of an E-Commerce Store?

Best Fit: Virtual Accounting

Online businesses should try online teams for accounting. As you mostly communicate through virtual channels, like Microsoft Teams, Slack, and more, you should hire outsourced accountants to handle most of your financial tasks.

How Can I Manage Scaling Quickly or Operating in Multiple States?

Best Fit: Virtual Accounting

Multiple locations mean more costs if you decide on establishing physical teams. Choose remote outsourced accounting to make sure your tasks regarding transactions, invoices, and taxes are managed 24/7 without the need for a lot of resources.

When I’m in a Budget Constraint for My Office?

Best Fit: Virtual Accounting

Hiring outsourced accountants for tasks is the best option if you are on a budget. Your usual costs will be to pay them hourly, weekly, or monthly, depending upon what suits you. Outsourcing from countries like India will only cost you $7.99 starting.

How to Transition from Traditional to Virtual Accounting?

There are no clear, designed steps that can tell you how to fool-proof transition from the traditional accounting to virtual outsourcing accounting. However, our team researched and found some ways in which you can make an internal switch without disturbing your existing teams for accounting tasks.

Start with Evaluation and Preparation

Before making the switch, assess your current accounting setup and identify what needs to be digitized or upgraded. Take stock of your workflows, records, and software usage. This helps in creating a clear roadmap for a smooth transition to a virtual environment.

Key steps to begin:

- Review your existing accounting systems and document workflows.

- Identify outdated or manual processes that can be automated.

- Choose a reliable virtual accounting agency or platform.

- Prepare and digitize essential financial records.

- Educate internal staff on the upcoming changes.

Ensure a Smooth and Problem-Free Transition

To avoid mismanagement, migrate your data in phases and test each system before full implementation. This allows time to fix issues and ensure the new tools function as expected. Collaborate closely with your virtual accountant to align goals and maintain accuracy during the shift.

Communication is key. Keep all stakeholders, team members, partners, and bookkeepers informed and involved throughout the transition. Offer training sessions on new platforms and maintain access to your old system temporarily in case of troubleshooting.

Also read: Guide To Outsourced Accounting

Best Tools for Accounting with In-House or Outsourced Accounting Teams

Maybe you have already made the switch to outsourced accounting. However, choosing which tools to choose is now becoming a barrier. Let us help you choose tools that will help you simplify your accounting records effortlessly.

For in-house teams or outsourced virtual accountants who function in the U.S., you can use:

- Patriot Accounting – U.S.-focused tool for small businesses; pricing starts at $20 monthly.

- TaxSlayer Pro – Trusted for professional U.S. tax filing and e-filing solutions, priced at $1,295/year.

If your business deals with global operations, then the following tools should be your first choice:

- Xero – Cloud-based, ideal for international teams; supports multiple currencies, with pricing starting from $15/month.

- Sage Business Cloud Accounting – Trusted by global firms, with scalable options for SMEs, the most affordable option at $10 per month.

- NetSuite ERP by Oracle – Enterprise-level global financial management tool, contact them for custom pricing.

Lastly, if you have an existing remote team but deal with particular finances, you can go for:

- Gusto – Streamlines payroll, tax filing, and employee benefits, you have to pay $40/month + $6/user.

- Avalara – Automates sales tax compliance and reporting across states and countries.

- ADP Run – Full-service payroll and HR compliance, especially for U.S. firms.

- Expensify – Expense management and tracking for teams and contractors, free plan available with limited features or $5/user/month.

- Fathom – Financial analysis and performance reporting for strategic decision-making, starts from $44/month.

- TurboTax Business – Specialized for corporate and self-employed U.S. tax prep, budgeted option at $170/year.

You can check out a list of tools suggested by our virtual accountants, who work with many offshore clients and businesses;

- Best Accounting Software for Small Business

- Best Construction Accounting Software

- Top Bookkeeping Software for Small Businesses

- Top Accounting Software for Property Management

- Best Invoicing Software For Small Businesses

You Can Say..

The differences between traditional (in-house) accounting and virtual (outsourced) accounting can be huge. Yet, you have both options to choose from. We revealed the most versatile accounting type you should choose and why.

Our team also mentioned the pros and cons of accounting in both cases. The last thing to do is to help you finalize your decision for the switch! If you are ready to choose virtual accountants over other options, you can connect with Invedus. We are experts at providing a dedicated virtual accountant for your financial responsibilities. Expect to:

- Be free from daily accounting tasks.

- Save money while staying compliant.

- Bearing no mind of managing and salaries.

Invedus does it all!

Ready to Simplify Your Finances? Get in Touch With Us.

Traditional vs Virtual Accountants FAQs

Q2. Can virtual accountants provide the same level of personal interaction as traditional accountants?

No, virtual accountants can offer efficient digital communication but lack the personal touch of face-to-face meetings. Even though this is the case, modern communication tools, such as Slack, Zoom, Docx, Excel, and more have made it easier for virtual accountants to improve their communication methods.

Q3. How do virtual accountants handle tax preparation and filing?

Virtual accountants manage tax preparation and filing digitally and remotely. Clients upload their tax documents securely online, after which the accountant reviews, prepares, and files the return electronically. Many virtual accounting services also allow clients to work with the same tax professional annually to maintain personalized services.

Q4. What is the difference between traditional and modern accounting practices?

Traditional accounting relies on manual bookkeeping, paper-based records, and physical documentation. Processes are time-consuming, labor-intensive, prone to human error, and less scalable.

Modern accounting uses digital tools, cloud-based software, and automation to handle financial tasks. This approach is faster, more accurate, cost-effective, and allows real-time access to data from anywhere. Modern systems also provide better integration with other business tools, enhanced reporting, and support for remote work.

Q5. Is AI replacing accountants?

No, AI is not replacing accountants. Still, the recent use of AI and automation tools in the profession has made tasks easier and time-efficient.

AI has allowed accountants to delegate daily or routine tasks to tools and take on more complex financial tasks, such as financial analysis, strategy, and advisory services. Without eliminating skilled professionals, AI can increase the productivity and accuracy of tasks.

Last updated on: Nov 19, 2025