Top Crowdfunding Platforms for Startups

Did you know that you can raise money for your startup or venture without relying on banks? Crowdfunding is a powerful way to connect with potential investors and customers who share your vision and passion.

Today we are enjoying the golden phase of the digital era, where startups, small businesses, and entrepreneurs collect money to boost their businesses via crowdfunding.

According to a report by Statista, the global crowdfunding market size was estimated to be 1.41 billion dollars in 2023, and it was expected to grow at a compound annual growth rate (CAGR) of 14.5 percent, more than doubling by 2030.

One of the biggest platforms for crowdsourcing is Kickstarter, which launched over 592,000 projects in May 2023. These projects range from creative arts and crafts to innovative technologies and social enterprises.

Crowdfunding allows people to support their favorite ideas and entrepreneurs, as well as to discover new opportunities and possibilities.

So, let’s unleash every topic in detail.

What is crowdfunding, and why is it a topic that attracts entrepreneurs, small businesses, and startups?

Crowdfunding is basically a method where small businesses, startups, and entrepreneurs look for an investor and elaborate their thoughts, ideas, proposals, business deals, etc. in front of them to raise funds to flourish their ideas, thoughts, and proposals to boost their businesses, and in lieu of this, these small businesses, entrepreneurs, and startups either offer their shares or services in terms of providing human resources, like outsourcing services.

Crowdfunding has a positive impact on entrepreneurs, small businesses, and startups. Because these companies will not have to pay higher interest rates or mortgage any of their real estate.

Apart from that, crowdfunding appeals to entrepreneurs, small businesses, and startups due to its democratized funding model. It enables them to raise capital from a diverse pool of backers, validating their ideas, building a community, and mitigating reliance on traditional financing channels. This inclusive approach fosters innovation and helps bring creative projects to life.

Why Crowdfunding is a preferred option for startups and business owners over the banking system

Startups and business owners often prefer alternative financing options over traditional banking due to flexibility, speed, and accessibility.

Many financial platforms offer streamlined processes, quicker approvals, and more lenient criteria, enabling businesses to secure funding rapidly.

Undoubtedly, crowdsourcing is a difficult way to raise capital because it raises a lot of questions in the minds of potential investors. However, it is a win-win situation for entrepreneurs, small businesses, and startups.

Additionally, these alternatives often cater to the specific needs of startups, providing customized solutions that may be more adaptable than traditional banking services. The digital nature of fintech also fosters convenience and efficiency, aligning well with the dynamic and innovative landscape of modern finance.

Some founders also complement crowdfunding with personal financing; providers like Griffin Funding offer flexible mortgage and home loan options that can unlock home equity to support early-stage growth.

What benefits does crowdfunding offer investors?

Investors were skeptical during the venture’s early stages, but once they committed to funding it, they realized it would be a profitable endeavor. For instance,

- As they begin to invest, investors will receive shares of the company.

- Investors have the option to demand that the company pay for services like staffing at a minimal cost in exchange for their investment.

- Investors will receive large returns.

- Crowdfunding platforms have a global reach, allowing entrepreneurs to access potential backers from around the world.

- Investors might get early access to the product or service before it is officially launched to the public. They can also diversify their portfolios by exploring different opportunities, without sticking to traditional options, and learn about investing in gold and other alternative assets that offer long-term stability.

How it will assist small businesses

Venture capital investments are not always profitable for investors. Indeed, it is a lucrative deal for business owners as well. For instance,

- Businesses will get funding without mortgaging their business and capital.

- Entrepreneurs get chances to interact with skilled business tycoons.

- Startups will get a chance to get suggestions from advanced experts.

- Small businesses are empowered by crowdfunding because it gives them access to capital from a wide range of supporters, which they can use to grow their enterprise.

- This democratized funding model reduces reliance on traditional financial institutions, enabling businesses to realize their ideas and innovations

Strategies for Crowdfunding campaigns

Craft strategies for successful crowdfunding depend on careful planning, execution, and good communication. You can craft strategies in three parts to accomplish your fundraising goals.

- Pre-Campaign Strategies

- Ongoing Campaign Strategies

- Post-Campaign Strategies

Pre-Campaign

1. Build an audience

Identify your target audience and start building relationships with them well before your campaign launches.

Social media, email marketing, and content marketing are effective ways to learn about your audience.

These tools can assist you in reaching your audience and developing a relationship with them through targeted advertising.

2. Look Up the Most Recent Trends for Your Projects

It is very important to update your knowledge base regarding the latest trends in your project. After that, choose the right crowdfunding platform and target audience for your business.

Further, develop a detailed plan for your campaign according to the latest updates, including your target funding goal, timeline, marketing strategy, and rewards structure.

3. Craft a Product story and High- Visuals

Crafting a story that will relate your product to their problems and that your product is the best solution for their problems. This will help the audience understand the utility of your product in their lives.

Say you have developed a navigation system that not only shows you the quickest route home but also takes away your anxiety about taking a different route.

If you just present your product to potential investors, it is possible that they will not be interested because it does not sound exciting. But if you have a problem like that, say you find a long line of traffic when you get home, which will cause you to be late, you can use this sophisticated navigation system to cut down on the amount of time you spend stuck in traffic.

This will create excitement regarding your product, and you can shoot up their excitement by showing them visuals of traffic and the issues related to it. A professional presentation goes a long way toward building trust and credibility.

Campaign Launch and During

4. Generate early momentum

Frontload your campaign by securing a collection of money from friends, family, and early supporters. This creates a sense of momentum and attracts more interest from a wider audience.

5. Actively engage with your audience

Respond to comments and questions promptly on different social media platforms. Share updates on your progress and offer exclusive content to your investors and supporters. This will make them feel valued and appreciated for their support.

6. Promote your campaign across multiple channels

These days, social media, email marketing, press releases, and influencer outreach are all great tools for expanding your audience’s reach. Collaborating with pertinent groups and communities can assist you in taking advantage of their networks.

7. Be transparent and build trust

Transparency is the core of any business. Transparency and trust are essential for successful crowdfunding. Provide clear and concise information about your project, finances, and team to your investor. Address any concerns or questions honestly and openly. It will support you in gaining the investor’s trust.

8. Stay flexible and adapt

Be prepared to adjust your strategy based on the campaign’s performance and feedback from your audience. Any gaps in your services and products will be filled by the input from your investors. Don’t be afraid to experiment and try different approaches to reach your target goal.

Post-Campaign

9. Deliver on your promises

As soon as possible, fulfill your rewards and inform your investors of your advancement. To your investors, this report will provide an update.

Exceed their expectations whenever possible to build lasting relationships and encourage future support.

10. Maintain relationships with your investors

Stay connected with your investors and supporters after the campaign ends. Post regular updates on the successes and advancements of your project on social media. Furthermore, you can also offer exclusive opportunities and discounts to your loyal supporters.

Best Online Platforms for Crowdfunding for Startups

Indiegogo

This crowdfunding platform is the best place to interact with brilliant and innovative ideas. It was launched in 2008 and across the globe, with over 19,000 campaigns launching monthly.

All things considered, Indiegogo’s flexibility, functionality, and capabilities are unmatched. Being one of the biggest global crowdfunding platforms, it also gives campaigns access to a multitude of investment opportunities.

Till now, more than 10 million people have visited their website, and 47% of campaigns are run by women.

With over 235 countries and territories represented, this international fundraising platform has more than 9 million backers. Additionally, this platform adheres to the motto, “Always search for fresh approaches to common problems.”

Platform fee: 5% across all crowdfunding campaigns.

CircleUp

CircleUp, which specializes in equity crowdfunding, is ideal for established startups, high-growth startups, and consumer product startups.

The crowdfunding platform has been around since 2010 and has helped over 250 companies raise $390 billion in funding.

Projects on this platform can only be funded by accredited investors. Since fewer campaigns are accepted on this platform than not, those that are accepted have a higher chance of achieving their funding targets. As a result, campaigns that are active on this platform tend to be highly successful.

Pricing: Depending on the amount raised, commission varies.

Kickstarter

This online crowdfunding website is best known for its creative projects, but it can also be used by startups. Kickstarter offers an all-or-nothing funding model, which means that startups only receive the money they raise if they meet their funding goal.

Kickstarter was launched on April 28, 2009, and till now they have reported tremendous growth. 23 million people have supported a project, contributing over $7.7 billion in pledges. This has helped fund the successful launch of 250,941 projects, an average of roughly 49 projects funded, $15 million pledged, and 4,500 people backing projects each day.

This level of engagement demonstrates the power of crowdfunding to bring creative ideas to life and help startups succeed.

Platform fee: 5% of total funds raised

GoFundMe

GoFundMe is a well-known online fundraising platform that allows people to raise money for a variety of causes and events. It is one of the most popular crowdfunding platforms in the world, with millions of users and billions of dollars raised to date.

GoFundMe is a trusted leader in online fundraising. You may fundraise or donate with confidence if you have straightforward pricing and a group of trust and safety specialists on your side.

Pricing: Depending on the amount raised, the commission varies

Patreon

Established in 2013, Patreon is a well-known crowdfunding platform targeted at online content creators, including writers, musicians, journalists, and artists.

Patreon has more than 8 million monthly active members and more than 250,000 creators who have collectively earned $3.5 billion.

Although creators can create a Patreon page for free, the platform takes a cut of the money they make from monthly or yearly subscription fees, ranging from 8% to 12%.

Patreon is one of the most popular crowdfunding sites that allows content creators to monetize their devoted audiences through a recurring revenue model, rather than focusing on funding individual projects or causes.

Pricing: Starting a Patreon Platform is free

Venture Crowd

With its headquarters located in Sydney, VentureCrowd is an Australian platform that facilitates crowdfunding for multiple asset classes, including debt-based, equity-based, and real estate crowdfunding.

VentureCrowd is at the forefront of Australia’s equity crowdfunding landscape, uniting a dedicated team committed to shaping a positive future.

Their primary responsibility is to act as the leading platform for investments, utilizing crowdfunding to stimulate groundbreaking ventures.

Their mission is to democratize impactful investments, enabling innovators to connect with their crowd and investors to support ventures aligned with their beliefs. By fostering accessibility and impact, VentureCrowd empowers a collective journey toward a better future, affirming the potential of inclusive and purpose-driven investment opportunities.

With the help of investors, the 73,000-person team has so far raised $296,000,000.

Pricing: 5%–12%, depending on the subscription plan.

Seedrs

Seedrs is Europe’s leading equity crowdfunding platform. It allows businesses to raise capital from a large pool of investors, and investors can access a wide range of exciting investment opportunities.

Seedrs was founded in 2009 and has since helped businesses raise over £2.6 billion from over 2037 successful deals. It is a regulated platform, meaning all businesses raising capital on Seedrs must undergo a rigorous screening process. This helps to protect investors and ensure that they are investing in high-quality businesses.

Seedrs offers a wide range of investment opportunities, from well-established companies to early-stage startups. Investors benefit from a secondary market for trading shares, a nominee service ensuring anonymous investments, and the support of a dedicated task force comprising experts to assist businesses in their capital-raising endeavors.

Pricing: Based on the amount invested by the business.

Fundable

This platform is designed for startups that are looking to raise equity funding. Fundable provides a range of resources and tools to assist startups in getting ready for and starting their crowdfunding campaign.

Till now, they have raised $700,000,000+ from 20,000+ Accredited Investors

Fundable is a software as a service (SaaS) platform that helps startups raise capital through various funding options. It provides a suite of tools and resources to help startups create a compelling pitch, attract investors, and manage their fundraising process.

Fundable is a self-managed fundraising platform for startups, offering diverse funding options like equity crowdfunding and debt financing.

With built-in marketing tools, startups can leverage social media, email, and press releases. The platform boasts a sizable network of accredited investors and provides data analytics for campaign monitoring and strategic decision-making.

Pricing: Based on the amount invested by the business.

One Planet Crowd

One Planet Crowd provides a platform for renewable energy projects and sustainable businesses to raise money from individuals and institutional investors.

The platform allows investors to browse projects, learn about their impact, and invest in them directly.

Oneplanetcrowd is a Dutch crowdfunding platform founded in 2012. It connects investors with sustainable projects and has successfully funded over 400 projects. With over 55,000 investors and €30 million invested, its success rate is 80%.

Oneplanetcrowd has funded projects in various sectors like renewable energy, sustainable agriculture, and social entrepreneurship. It has won several awards for its commitment to sustainability and social impact.

Pricing: 7% of the platform fee

Invesdor

One of the most well-known online investment platforms is Invesdor Finland, which helps Finnish startups and companies get funding.

With a robust network, the platform seamlessly connects investors with promising ventures spanning diverse sectors such as equity investment, fixed income, and renewable energy.

Invesdor sets itself apart by offering a comprehensive array of investment options tailored for both individual and institutional investors. Direct equity investment in new or developing businesses is one of these options.

As of now, they have connected with over 184,000 potential investors, supported by a wealth of experience with over 900 funded projects.

Their financing expertise, evidenced by brokering more than 531 million euros across 50 projects, is complemented by a strategic partnership that ensures comprehensive support for your venture

Pricing: 0.5%-2% of the fused capital.

IFundWomen

A reward-based crowdfunding site that is dedicated to supporting women entrepreneurs and their businesses. It offers coaching, mentorship, and networking opportunities for female founders, as well as access to grants and other resources.

IFundWomen serves as the primary funding platform for businesses owned by women, providing a comprehensive ecosystem for both entrepreneurs and supporters.

Through their premium online fundraising platform, they facilitate swift access to capital, enabling women-owned businesses to thrive. Additionally, they offer opportunities to secure small business grants from corporate partners, ensuring a diverse range of financial support.

Beyond financial assistance, IFundWomen delivers expert business coaching across essential entrepreneurial topics, empowering women with the knowledge needed for success.

Their network fosters connections among women business owners, fostering confidence, accelerating knowledge, and inspiring decisive action.

Pricing: Depending on the chosen plan

Wefunder

An equity crowdfunding site that connects startups with investors who can provide funding in exchange for a share of the company. It supports startups in various industries, such as biotech, food, entertainment, and software.

Wefunder is an equity crowdfunding platform that allows anyone to invest in startups. They provide founders with the tools and resources they need to raise capital and build their businesses, and they make it easy for investors to find and invest in promising companies.

Wefunder has been used by thousands of startups to raise capital, including companies such as SpaceX, Soylent, and Casper.

With 3,204 founders contributing $682M, WeFunder facilitated funding totaling $250K on average. This diverse support underscores the platform’s success in democratizing access to capital for entrepreneurial ventures.

Pricing: 7.5% of the platform fees

Here is a summary table that compares various online crowdfunding platforms suitable for startups and business owners.

| Platform | Key Features | Industry Focus | Funding Type | Notable Aspects |

|---|---|---|---|---|

| Indiegogo | Flexible funding options | Tech, Creative projects | Rewards, Equity | Global reach, supports innovative products |

| CircleUp | Curated companies, focus on retail | Consumer brands | Equity | Access to a network of sophisticated investors |

| Kickstarter | Strong community support | Creative, Tech | Rewards | High public visibility, all-or-nothing funding |

| GoFundMe | Personal and cause-based fundraising | General, Personal | Donations | User-friendly, suitable for urgent personal causes |

| Patreon | Subscription-based support | Artists, Creators | Subscriptions | Continuous funding, fosters long-term relationships |

| Venture Crowd | Equity crowdfunding focused | Real estate, Startups | Equity | Australian market focus, diverse investment options |

| Seedrs | European focus, secondary market trading | Startups, Various | Equity | Allows trading of shares in secondary market |

| Fundable | Business-oriented, U.S. focus | Startups, Businesses | Rewards, Equity | Offers both rewards and equity options |

| One Planet Crowd | Sustainable and social projects | Eco-friendly, Social | Loans, Equity | Focuses on sustainability and social impact |

| Invesdor | Wide European reach | Various | Equity, Debt | Supports pan-European investments |

| IFundWomen | Female entrepreneurs focus | Women-led startups | Rewards, Grants | Offers coaching, networking opportunities |

| Wefunder | Low entry investment minimums | Startups, Small business | Equity, Debt, Revenue Share | Democratizes investment, supports diverse businesses |

Which crowdfunding platform is best for startups?

Since every business has needs, target audiences, and project funds, the answer to this question is crucial. As a result, we advise you to select a platform that has a thorough understanding of your project.

Second, we advise you to conduct extensive background research on your backers. so that when you are raising money for your business, everything will run smoothly and without a hitch.

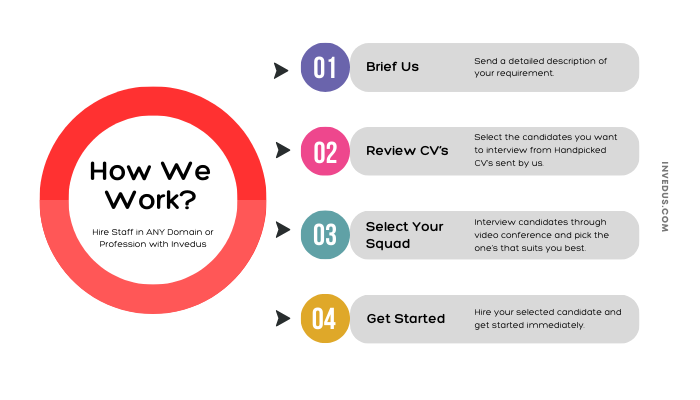

About Invedus

Are you looking for a way to grow your business without breaking the bank? Do you want to access the best talent and expertise from India at a fraction of the cost of hiring local employees? If yes, then you need Invedus, the leading provider of outsourcing services that helps you achieve your business goals with ease and efficiency.

Invedus offers a wide range of services, such as IT, digital marketing, graphic design, accounting, and virtual assistance. You can hire dedicated virtual employees from India who work exclusively for you, same as your own on-site recruit. You can also automate your entire employee management process, from talent search to onboarding to performance tracking.

With Invedus, you can enjoy the benefits of working across global time zones and having access to a pool of highly skilled and experienced professionals.

Invedus has been trusted by hundreds of small businesses, SMEs and big companies across the globe who have experienced the quality and affordability of their services. If you are interested in learning more about Invedus and how they can help you grow your business, contact us today.

Last updated on: Nov 13, 2025