Top 7 Strategies for Managing Your Accounts Receivable Aging Report

Managing accounts receivable (AR) is crucial for the financial health of your business. It’s not just about tracking who owes you money; it’s about ensuring that your business has the cash flow needed to thrive.

When AR isn’t managed well, it can lead to cash flow problems, making it difficult to pay your own bills, invest in growth, or even keep your operations running smoothly.

The Accounts Receivable Aging Report is a powerful tool that can help you stay on top of your receivables. In this guide, we’ll explore what an AR Aging Report is, why it’s important, and the top strategies for managing it effectively.

Understanding the Accounts Receivable Aging Report

Before diving into strategies, it’s crucial to understand the basics. Knowing what an AR Aging Report is and what it includes will give you the foundation needed to manage your accounts receivable effectively.

What is an AR Aging Report?

An Accounts Receivable (AR) Aging Report is a vital tool for businesses to track outstanding invoices. It categorizes these invoices based on how long they’ve been overdue, providing a clear picture of your receivables. Think of it as a snapshot that helps you understand the current state of your cash flow and customer balances.

Here’s why the AR Aging Report is important:

- Categorization of Invoices: It organizes unpaid invoices into time brackets (e.g., 0-30 days, 31-60 days, etc.), helping you see which payments are overdue and by how long.

- Financial Health Insight: Provides a quick overview of potential cash flow issues and customer balances, allowing you to take action before things get out of hand.

- Prioritization Tool: Helps you prioritize your collection efforts by focusing on the oldest and most overdue invoices first.

What is Included in an AR Aging Report?

An AR Aging Report contains several key components that are essential for effective receivables management. Understanding these elements will help you use the report to its fullest potential.

Key components typically included in an AR Aging Report are:

- Customer Name: Identifies which customer owes the payment.

- Invoice Date: Indicates when the invoice was issued, which is crucial for aging the receivable correctly.

- Amount Due: Shows the total amount owed by the customer.

- Aging Category: Breaks down the invoice into categories such as 0-30 days, 31-60 days, etc., based on how long the payment has been overdue.

- Outstanding Balance: Provides a summary of the total amount overdue per customer or invoice, helping you track and manage your receivables more effectively.

The Importance of Managing Your AR Aging Report

Now that you have a clear understanding of what an AR Aging Report is, let’s discuss why managing this report is vital for your business. Keeping a close eye on your AR Aging Report can prevent financial headaches and strengthen your business’s financial foundation.

Why is it Important?

Maintaining a healthy cash flow is one of the most important reasons to manage your AR Aging Report closely. When too much of your revenue is tied up in unpaid invoices, it can strain your ability to cover expenses and invest in new opportunities.

Additionally, regularly reviewing your aging report allows you to identify potential bad debts early, reducing the risk of significant losses.

By proactively managing overdue invoices and communicating effectively with customers, you also enhance your customer relationships, making it more likely that they’ll pay on time in the future.

Key Metrics to Watch

When managing your AR Aging Report, two key metrics are particularly important: the Accounts Receivable Turnover Ratio and AR aging percentage benchmarks.

- The Accounts Receivable Turnover Ratio measures how quickly you’re collecting your receivables— a higher ratio indicates faster collection, which is beneficial for your cash flow.

- AR aging percentage benchmarks help you assess how your receivables compare to industry standards, offering insights into whether your collection practices are effective or if adjustments are needed.

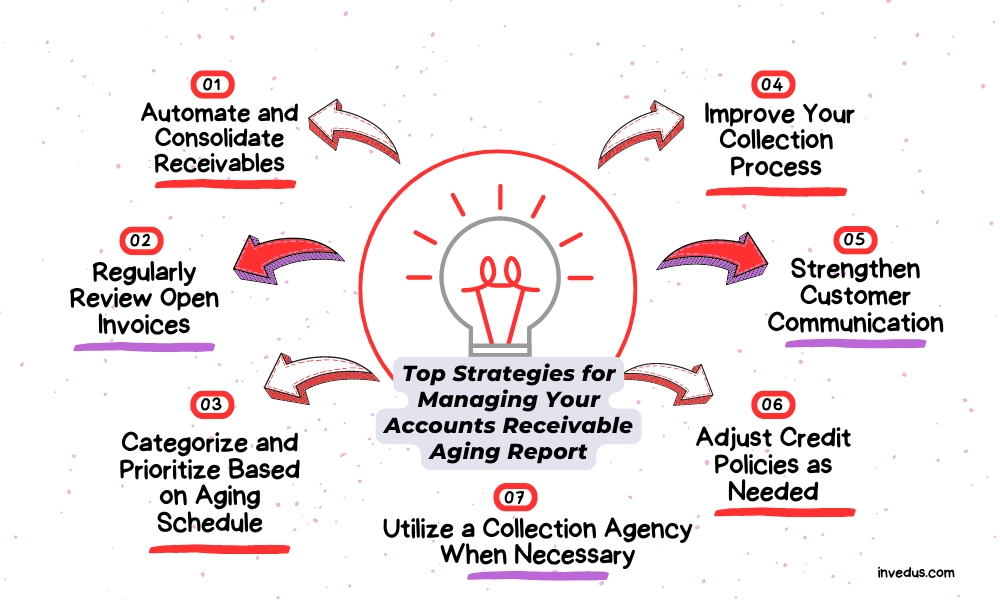

7 Strategies for Managing Your Accounts Receivable Aging Report

With a solid understanding of your AR Aging Report and its importance, let’s move on to some practical strategies for managing it effectively. These strategies will help you optimize your collections and maintain a healthy cash flow.

1. Automate and Consolidate Receivables

One of the most effective ways to manage your AR Aging Report is through automation. Automation tools can track and consolidate your receivables, ensuring that your aging report is always accurate and up-to-date.

These tools can also automatically send reminders to customers and flag high-risk accounts, saving you time and reducing the risk of errors. Automating your receivables management not only makes the process more efficient but also helps you stay on top of your cash flow.

2. Regularly Review Open Invoices

It’s easy to let open invoices slide, especially when you’re busy with other tasks. However, regularly reviewing these invoices is crucial to maintaining control over your receivables.

By setting a routine—such as a weekly or bi-weekly review—you can identify which invoices are nearing their due dates and which are overdue.

This allows you to follow up with customers promptly, increasing the likelihood of timely payments.

3. Categorize and Prioritize Based on Aging Schedule

Your aging schedule is more than just a list of overdue invoices; it’s a tool for prioritizing your collection efforts. Start with the oldest invoices first, as the longer an invoice remains unpaid, the harder it becomes to collect.

By focusing on older invoices, you can reduce the risk of bad debts and improve your overall cash flow.

Prioritizing based on the aging schedule ensures that your collection efforts are focused where they’re needed most.

4. Improve Your Collection Process

If you’re struggling with overdue invoices, it might be time to refine your collection process. Consider offering early payment discounts to incentivize customers to pay sooner, or implement late payment penalties to discourage delays.

You might also want to introduce structured payment plans for customers who are having difficulty paying in full.

The goal is to make your collection process as clear and easy as possible for your customers while encouraging prompt payments.

5. Strengthen Customer Communication

Good communication is key to effective AR management. Don’t wait until an invoice is overdue to reach out to your customers. Regularly touch base with them about their accounts and remind them of upcoming due dates.

Strong relationships with your customers not only improve payment timeliness but also enhance their overall experience with your business. Customers who feel valued are more likely to prioritize paying you on time.

6. Adjust Credit Policies as Needed

Your AR Aging Report provides valuable insights into your credit policies. If you notice a pattern of late payments, it might be time to reassess your credit terms. Consider tightening credit limits or shortening the payment window to reduce the risk of overdue invoices. Adjusting your credit policies based on the data in your aging report can help you manage your receivables more effectively and maintain a healthy cash flow.

7. Utilize a Collection Agency When Necessary

Despite your best efforts, some invoices may remain unpaid. In such cases, it may be necessary to involve a collection agency. While this should be a last resort, a reputable collection agency can help recover debts that you’ve been unable to collect on your own.

When choosing an agency, make sure they align with your values and handle collections in a manner that respects your customer relationships.

Forecasting and Planning with Your AR Aging Report

Effective management of your AR Aging Report doesn’t just help with current receivables; it also plays a critical role in forecasting and planning. By analyzing your aging data, you can make informed decisions that will benefit your business in the long run.

Using the Report for Cash Flow Forecasting

Your AR Aging Report is an excellent tool for predicting cash flow. By analyzing the data, you can estimate when you’re likely to receive payments, allowing you to plan your expenses and investments more effectively.

For instance, if your report shows that most receivables are collected within 30 days, you can confidently plan for cash availability in that timeframe.

Forecasting based on your aging report helps you avoid cash shortages and ensures that your business has the funds it needs to operate smoothly.

Identifying and Managing Bad Debt

Bad debt is an unfortunate reality for any business, but your AR Aging Report can help you manage this risk. By regularly reviewing your report, you can identify accounts that are likely to become bad debts and set aside reserves to cover potential losses.

This proactive approach allows you to minimize the financial impact of bad debts on your business. Additionally, by addressing overdue accounts early, you can reduce the likelihood of debts becoming uncollectible.

Common Challenges and How to Overcome Them

Managing your AR Aging Report effectively comes with its own set of challenges. However, with the right strategies in place, you can overcome these obstacles and keep your receivables under control.

Identifying Complications Early

One of the biggest challenges in managing your AR Aging Report is identifying issues before they escalate. Regularly reviewing your aging report and staying vigilant for unusual patterns—such as customers who suddenly start paying late—can help you catch problems early.

Early detection allows you to address these issues before they impact your cash flow, ensuring that your business remains financially healthy.

Managing Delinquent/Overdue Accounts

Dealing with delinquent/overdue accounts is never easy, but it’s a necessary part of managing your receivables. The key is to have a clear, consistent plan in place. Start by sending reminders as soon as an invoice becomes overdue, and escalate to more formal collection efforts if necessary.

In some cases, you may need to consider legal action or writing off the debt. By having a structured approach to managing delinquent accounts, you can minimize the impact on your business.

To Wrap Up

Managing your Accounts Receivable Aging Report is essential for maintaining the financial health of your business. By consistently monitoring your aging report, regularly reviewing open invoices, and using the data to adjust your policies and processes, you can improve your cash flow, reduce bad debts, and strengthen your customer relationships.

Effective AR management isn’t just about tracking overdue payments—it’s about ensuring your business has the financial stability it needs to grow and thrive.

If you’re looking to streamline your financial management processes, consider partnering with Invedus Outsourcing. With over eight years of experience in finance and accounting outsourcing, Invedus offers specialized services tailored to your business needs.

From daily accounting activities to reconciliations, payroll processing, and financial analysis, Invedus has the expertise to handle your end-to-end accounting processes.

Let us help you maintain a strong financial foundation while you focus on what you do best—growing your business. Contact us today to learn more about how our services can benefit your business.

Last updated on: Aug 16, 2024