Hire Accounts Receivable Specialist – 7 Tips You Must Know

Are you also struggling to get the right accounts receivable specialist for your organization? Then you are also a part of 27000+ businesses, startups, and SMEs that are on the lookout for the same.

But before you proceed with the deep dive into your hunt for hiring the right accounts receivable specialists for your business, just keep in mind some tips that ease your task of hiring the right AR specialist.

Let’s find out what these tips are. Also, get the best AR specialist for your business who allows you to free up your time so that you can make strategies for your empire. But before that, have a glimpse of an accounts receivable specialist who is responsible for managing your company’s cash crunch.

Who is an accounts receivable specialist, and What do They do?

Their name itself defines the job they perform for your organization. An Accounts Receivable Specialist is responsible for managing incoming payments, ensuring accurate and timely processing of invoices, and maintaining detailed financial records. They also handle customer queries regarding billing and facilitate the resolution of discrepancies in payment records.

But the question arises, do AR specialists simply collect and track payments for the company?

The answer is a “Big No”. Their job is not only confined to gathering information on the customers’ dues. They are performing more jobs than that.

Let’s find out what they do other than accumulating cash from customers who have opted for credit facilities.

- Keep an eye on the aging period.

- Interacting with the clients and seeking a solution to the issue of resolving payments

- Checking, preparing, managing, and maintaining the invoices.

- Maintaining accounts and checking discrepancies if they found any.

- Drafting, reforming, managing, and maintaining the credit policies.

- Responsible for paying all the company’s bills and keeping a track record of it. So that, they can make policies for customers and must have a record if there is any mismatch in accounts.

Though the list of accounts receivable specialists’ jobs is too long, in the above, we defined only a few.

Now check out what points need to be kept in mind while hiring the accounts receivable specialists.

7 Tips You Must Know Before Employing an AR Specialist

Undoubtedly, accounts receivable specialists are the backbone of any organization. There is no scope even for a single mistake. So, keep in mind some facts that can make your choice of hiring an AR professional easier. Let’s proceed and unleash what these are.

1. Clearly define your business requirement

It is very important for you, as a director, entrepreneur, or businessman, to clearly state your requirements to them. Give them a detailed overview of your expectations, don’t hide even a single point, and put your thoughts on what you and your business are expecting from them.

Don’t be hypothetical that they have successfully read the JD. However, there may be a chance that the AR specialist you are going to interview will be the next account receivable professional in your organization. So, in that case, don’t take any risks and transparently state your thoughts and requirements to them.

Additionally, you can do:

- Tell them your business hours

- Mode of payment they are accepting.

- Give them an overview of your banks and relationship managers.

- Mode of interaction with your customers and clients.

- Give them an overview of your clients.

Make sure that this is a cordial conversation.

2. Take a deep look at their technological know-how

You are living in a technological era, you cannot think of even a single interaction without using technology. So, be sure the AR specialists you are going to hire are compatible with the existing technologies and well-versed in using the new technologies.

Additionally, they must be quick learners at grasping, learning, adapting, and implementing new technologies.

To check this, it is good to assign them any task that consists of the use of the technologies that you want your next accounts receivable specialists to use in your organization.

3. Create a screening process to verify their skills match your business needs.

This stage is very crucial before you choose the perfect AR expert for your organization. Don’t just screen the accounts receivable specialist to hire them. In fact-screen them to check whether they are able to tackle the situations that your business is facing very frequently, and you might think that these situations may impact your business in the future. Have they come up with any solution to that issue or just bulked with those outdated solutions?

Your screening procedure should be a combination of

- Written tests– Used to determine their writing skills, like how they respond to your customers and clients.

- Scenario-based situation– Able to check their decision capability in different scenarios.

- Group Discussion– This helps you identify their interpersonal skills or how they deal with adamant customers.

4. Approach AR specialist using the right channel

Make sure that you are not hiring an employee; you are hiring a balance sheet and reputation for your organization. So, it is always good to choose the right social media platform to access these excellent talents.

Ensure that, you share the JD and requirements for accounts receivable specialists should be enlisted on popular platforms like Linkedin, Indeed, Glassdoor, etc.

Also, adding on the JD you share on different portals must be rectified by your website as well. Alternatively, post these jobs using your business profile. Furthermore, also ensure your company and employees are visible and approachable on these social media platforms.

These steps build reliability and deepen trust in your organization.

Additionally, your JD should be as effective and clear that none of the future AR experts for your firm is left with any doubts.

5. In the interview, thoroughly assess their varied skills.

It is very important to observe your next accounts receivable specialist carefully. Just break down your interview process into multiple fragments to check their skill compatibility.

Each activity should be broken down in such a way that when a candidate should proceed with that assigned activity, it must be a parameter to check their skills.

Likewise, during the conversation, verify how much they grasp your words, and how they respond to your words. Also, this activity helps to check their patience level and whether they lose temper or show patience in that situation.

Additionally, this conversation helps you identify their soft skills of interaction and communication.

6. Design scenarios to evaluate their skills and behaviour in various contexts.

Put them in different scenarios to check their relevant account-related skills. Use these skills for your next accounts receivable professional to manage accounts receivable, record transactions, and reconcile accounts.

On the list of all skills, these accounting skills come first. You cannot compromise on their ability to manage their accounts, even though other skills may be somewhat compromised.

So, it is important to create some scenarios that consist of all the tasks that can evaluate AR specialists all the expertise in the accounting domain.

7. Last but not least, check their basic skills in mathematics and accounting very minutely.

Don’t take otherwise the aspect of accounting or keep a presumption that an AR specialist is well-versed in performing the basic maths and accounting tasks. Checking their ability in mathematics and accounting makes it an integral part of the hiring process.

Yes, you are absolutely right whosoever is an AR expert already gets the basics and advances of maths and accounting but it is recommended to ensure their these basic skills. So that, it should not happen the accounts receivable specialist you are going to hire is an expert in all the segments but fails in clearing the fundamentals of maths and accounting.

To ensure their mastery in these subjects use the Basic Triple-Digit Math test and Intermediate Math test to assess their proficiency.

Also Read: 6+ Most Convincing Reasons to Outsource Your Accounting Services

Should You Expand Your Accounts Receivable Team?

Is your accounts receivable team overwhelmed with their current workload? Are you facing pressure from the CFO to enhance AR operations?

If your company is experiencing rapid growth and your existing AR staff is struggling to manage the volume of receivables, it might be time to consider adding a new member. You’ll need to weigh the costs of additional salary and benefits against the time needed for your team to train the newcomer. After assessing these factors, reevaluating your current resources to see if efficiency can be improved may also be a valuable step.

Closing Tips for Hiring Accounts Receivable Specialist

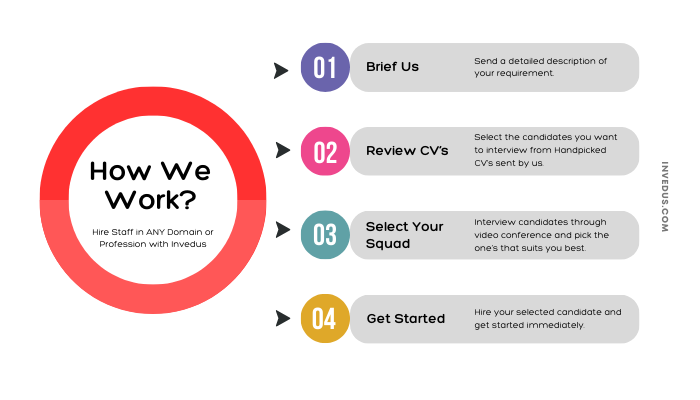

Through the above, we have provided handy tips to make your hiring successful. If you are still left with any doubt and seeking the best Accounts Receivable Specialist for your business. Contact Invedus and choose the top AR expert from the top 3% of the talent.

Invedus as an effective solution for those in search of an offshore accountant. Invedus stands ready to help businesses expand their teams with dedicated professionals. These experts are committed to precision and efficiency in managing your accounts, whether you need a single dedicated employee or an entire team.

Invedus offers a tailored service that fits your specific financial management requirements, integrating smoothly with your current operations. Discover how Invedus can refine your accounts receivable process and support your business’s growth.

Last updated on: Nov 19, 2025