2025 Best Billing and Invoicing Software for Your Business and Ventures

Whether you run a small business, a startup, or a freelancer, you don’t have enough time to manage your finances. In this scenario, either hire an onsite accountant or use invoicing software for small businesses or billing software.

These applications help you track your financial record, the goods, and services you provide, and how much customers owe.

The best invoice builder also lets you automate all the steps in online invoicing, such as creating estimates, recording hours worked, and collecting payments. Additionally, as a small business owner, or freelancer, the billing software you choose needs to include all of these features in addition to mobile apps and more.

Often, small business billing and Invoicing software has built-in features that offer everything you need to promote your business. But due to a lack of time, you don’t have enough time to invest in these apps.

However, by hiring an offshore accountant, you can solely focus on your business and leave financial management to the experts.

Below, we have compiled a list of the best billing software for small business operations, each tailored to address unique needs:

1. Quickbooks

Quickbooks is accounting software that facilitates the management of business accounts and finances. Accountants choose this option over others because it makes entering data easier. It also manages their other tasks, like time tracking, budgeting, inventory tracking, invoice sales tax management, bank reconciliation, and others.

With a full feature set, this cloud-based accounting software assists small and medium-sized enterprises manage their finances efficiently. Additionally, QuickBooks Online integrates with various third-party applications, providing businesses with a seamless and efficient accounting experience.

How Quickbooks Makes Billing Easy

QuickBooks is dedicated to assisting your business to succeed, regardless of whether you are an accountant, bookkeeper, small business owner, or sole proprietor. With Quickbooks billing, one can effortlessly manage their finances in real-time and on a smart and secure platform.

In addition, automate accounting, monitor your finances constantly, file taxes, receive payments, and manage your employees.

Standout features

- Create and send professional invoices to clients, track invoice status, and accept online payments.

- Maintain inventory levels, establish reorder thresholds, and create purchase orders.

- Project management involves working with team members, controlling time and expenses, and keeping track of a project’s profitability. (QuickBooks Online Plus and higher)

- Manage payroll for your employees, including direct deposit and tax filing. (Separate subscription required)

- Enable you to create tax forms, automate tax computations, and streamline tax filing.

- Income and Expense Tracking: Record sales, bills, and other financial transactions.

- Automatic Banking and Bill Pay, let Sync your bank accounts for automatic downloads and pay bills electronically.

- Create financial reports, such as balance sheets and profit and loss statements, to get information about the performance of your company.

- Access your QuickBooks data with its mobile app and manage finances on the go.

Quickbooks Best For?

QuickBooks is a good option for small and medium-sized businesses, as well as nonprofits, that need accounting software. It can handle basic tasks like invoicing, billing and inventory tracking, as well as more complex tasks like managing accounts payable and receivable, employee records, and tax filings.

This billing software also offers a variety of features, including payment management, expense tracking, and multiple integrations. Due to its high level of security and user-friendly interface, QuickBooks Online is recommended by many accountants as being simple to use by small teams.

It is also considered one of the best e-commerce accounting software because it has direct integration with well-known e-commerce platforms, allowing e-commerce data to be transferred to your accounting system without any hassles.

Its advanced tracking sales tax features will also be advantageous to businesses. enabling you to monitor, set, and include sales taxes. You can view this feature on the invoice creation screen.

Pros

- Easy to learn and run this billing and invoicing software. After signing in, book a free 45-minute onboarding session with their experts.

- You no longer need to worry about tax return errors. Their error-checking software will automatically sort and calculate your VAT, submitting your tax return directly to HMRC.

- The advanced billing software Sets up reminders so you always know what tax you owe and when it’s due.

- QuickBooks invoicing software enables you to automate pay runs, pension auto-enrollment, and payroll tax auto-filing to HMRC through software approved by HMRC.

Hangups

- QuickBooks primarily focuses on accounting reports, and may not offer comprehensive business insights for areas like marketing or sales.

- Depending on your plan, you might have limited access to live support, with troubleshooting relying on help articles or online forums.

- As your business grows, QuickBooks’ capabilities might not scale as effectively. File size limitations and user restrictions could become an issue.

Pricing

Free trial for the first 30 days, then enjoy a 90% discounted price for the next 6 months. Then enjoy the different plans.

- Self-Employed (For Sole Traders not registered for VAT): £ 1/m

- Simple Start (For sole traders or small businesses managing VAT, or income tax): £ 1.40/m

- Essentials (For small businesses): £ 2.80/m

- Plus (For businesses managing projects, stock, VAT, and Income Tax): £ 3.80/m

- Advanced (For businesses needing automatic data backup, custom permissions, and reporting): £ 9/m

Quick Evaluation

- Version – Cloud and Desktop

- Free Trial Available– Yes, for 30 days

- Pricing Discount Available– 90% for the next 6 months

- Phone and Chat Support- Yes for every plan

- Average Rating– 4.3 out of 5 on average, based on 3299 reviews. (Source: Capterra)

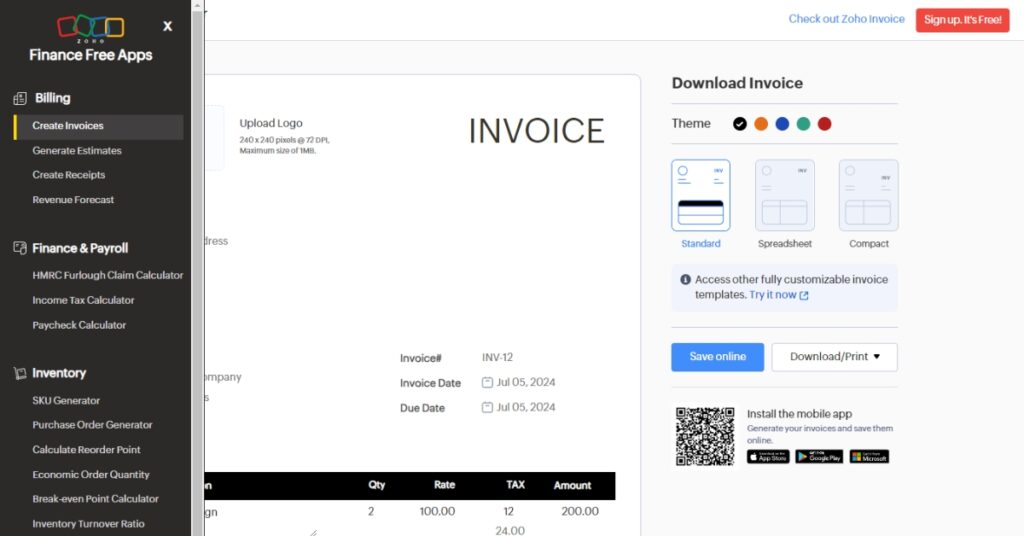

2. Zoho Invoice Generator

Zoho Invoice is a cloud-based billing and invoicing software designed to help small businesses manage their billing processes. It provides paid plans with more features in addition to a free plan with limited features.

You are allowed to outline your payment terms, terms of sale, and deliverables, in a well-crafted quote. Once it is approved, they can automatically be converted into invoices.

Also, you can track your project hours and charge customers accordingly. Allow your staff to log in from their devices, and Zoho Invoice calculates the total amount owed.

How Zoho Makes Invoice Simple

Zoho provides pre-designed invoice templates that you can customize with your company’s logo and branding. This eliminates the need to design invoices from scratch, saving you time and effort.

The simplicity of using an app allows you to create professional invoices, manage time, and receive payments, in next to no time and at no extra cost. Just enjoy the cutting-edge simplified billing feature with Zoho Invoice.

Using Zoho Invoice Generator to process online payments is as easy as choosing your preferred payment gateway, generating invoices, and watching the income roll in.

Standout features

- Pick an invoice template from the gallery and customize every detail accordingly.

- Complete your invoice by managing the sidebar, keyboard shortcuts, and other modules with its flexible interface.

- Customize essential reports and metrics with a quick-to-grasp dashboard.

- Avoid any mess between your organization’s users. Assign their roles and allow them to access their role-based modules, reducing their monitor usage.

- Access your and your customer’s data by you and only you

Zoho Best For?

Zoho is best known for its Customer Relationship Management (CRM) software, Zoho CRM. It’s a popular choice for businesses of all sizes but particularly well-suited for startups and small businesses. Also, this cloud-based tools and products suite helps businesses manage their sales, marketing, customer support, and more simultaneously with their other business apps.

Additionally, Zoho One is unique and can be enjoyed. It’s an all-in-one suite that includes Zoho CRM, Zoho Books, and over 40 other Zoho applications. It provides a comprehensive set of tools for various business functions, from sales and marketing to finance, HR, and project management.

Pros

- It offers a free plan for its CRM, and its paid plans are generally more affordable compared to others.

- Zoho grows with your business. You can start with the free plan and upgrade to paid tiers with more features as your needs increase.

- Zoho offers a suite of applications that cover various business needs, including CRM, marketing, accounting, project management, and more.

- This billing and invoicing software, Zoho, is designed to make things easier for you. It can be integrated with other Zoho apps to handle a range of business tasks.

Hangups

- While generally considered user-friendly, Zoho can have a learning curve, especially for users unfamiliar with CRM systems or the vast number of Zoho applications.

- The wide range of applications can be overwhelming for some businesses, especially those that only need a few specific features.

Pricing

Free for small and medium-sized businesses, freelancers, and entrepreneurs. Once your company grows, get in touch with them to discuss a plan that will work for their needs.

Quick Evaluation

- Version – Cloud, Mobile, and Desktop

- Free Trial Available– Yes, for a lifetime (till now)

- Pricing Discount Available– Depends on business requirement

- Phone and Chat Support- Yes

- Average Rating– 4 out of 5 on average, based on 2639 reviews. (Source: G2)

3. Square Invoices

Square Invoices is a free, one-stop software for invoicing that enables companies to request, monitor, and handle payments for their estimates, invoices, and other documents all in one location. Their user-friendly software enables you to request, accept, and record any kind of payment method, which will help your business get paid more quickly.

Keep a close eye on how your company is doing and use the information you obtain to make well-informed decisions. This includes keeping tabs on all of your locations, staff, products, and services.

How Invoice on Square Makes Simple and Easy

- Square Invoices doesn’t charge monthly fees and boasts a user-friendly interface.

- Allows businesses to create invoices quickly without getting bogged down in complicated software.

- Customize your logo and branding for a polished look with the pre-designed invoice templates.

- Give your clients the flexibility to pay with credit cards, debit cards, Google Pay, cash, checks, or ACH payments directly through the invoice.

- Create and send invoices from anywhere using the Square Invoices mobile app.

- Scheduling recurring invoices and setting up automatic payment reminders.

Standout features

- Consolidate and manage all your invoices and cash flow in a central hub, like your business dashboard.

- Square Invoices allows you to create and send invoices, estimates, and contracts for free with no limits.

- Manage invoices and clients on the go from the Square Invoices mobile app.

- Organize estimates, invoices, contracts, and related files into project workspaces for easy access

- Send invoices via email, SMS, or share a link.

- Track the status of your invoices in real-time and see which ones are paid and unpaid.

- Add custom fields to invoices to capture specific details relevant to your business.

How Square Is Best for Invoicing?

- With its sophisticated automated feature, you can set up a payment reminder and have invoices sent and tracked automatically.

- Deliver bills straight to your clients’ phone numbers or email addresses, and let them pay with a single tap or click.

- Create personalized digital invoices that you can send via link, email, or SMS.

- Square Invoice gives you the ability to manage your money, keep an eye on cash flow, and track payments in real time.

- It supports multiple payment options, including Apple Pay, Google Pay, ACH bank transfers, Cash App Pay, and Afterpay.

Pros

- You can send a contract copy directly to your customer’s invoice.

- You can stay up to date on whether an online invoice is paid, unpaid, or overdue.

- There’s a free forever plan that allows you to send unlimited invoices and estimates. This is great for freelancers or SMEs.

- Easy to use, even a non-techy individual can easily operate Square seamlessly.

- Square Invoice integrates well with other Square products, like the point-of-sale system, making it convenient if you already use those tools.

Hangups

- Many of the more advanced features, like recurring invoices, batch billing, and custom branding, require upgrading to the paid Square Invoices Plus plan ($20 per month).

- Square Invoice isn’t a full-fledged accounting solution. It lacks features for complex inventory management, payroll, or in-depth reports.

- Customers need to pay processing fees.

Pricing

There are different plans available according to your and your business requirements.

- Free (processing fee included): When you accept the payment.

- Plus ($29+/mo.+ processing fees): Access advanced features designed specifically for restaurants, retailers, or appointment-based businesses.

- Premium: Based on the complexity of your operations.

Quick Evaluation

- Version – Cloud, Mobile, and Desktop

- Free Trial Available– Yes, for freelancers

- Pricing Discount Available– Depends on business requirement

- Phone and Chat Support- Yes

- Average Rating– 4.7 out of 5 on average, based on 4542 reviews. (Source: Forbes)

4. Freshbooks

Freshbook is a tool that allows you to track and manage your day-to-day business finances. You can create professional invoices, and enjoy its other features as well, such as invoicing features, expense tracking, time tracking, online payments, industry-standard double-entry accounting, balance sheets, mileage tracking, project profitability, bank reconciliation, client retainers, and more.

How Freshbooks Makes Invoice Simple and Easy

- Freshbooks provides pre-made invoice templates that you can tailor according to your business needs.

- Automate your tasks like invoice numbering and sending reminders to late-paying clients to avoid any hassle.

- Store client information in the system and generate their invoices quickly.

- Use Freshbooks mobile apps to create and send invoices.

- Clients can pay you directly through the invoice itself, expediting the payment process and saving you time chasing down checks.

Standout features

- Pick your template, add your logo, adjust colors and fonts, and do whatever you want to do to make sure your invoices wow your clients.

- Use the easy-to-use, customizable automatic payment reminders to avoid awkward nudging.

- You can easily configure FreshBooks to automatically apply a late fee when your invoice is past due, which will encourage your clients to pay you ASAP.

- You can set a due date for your invoices.

- Make sure to preview your invoices.

- Save a backup copy of your invoices so you have it for emergencies.

How is Freshbooks best for invoicing?

- Customizable designs and choose your business designs from a variety of customizable designs.

- Set up recurring invoices and automate late payment fees.

- Users can monitor the status of an invoice after sending it, including when customers receive and view it.

- Online credit and debit card payments, ACH transfers, Stripe, and PayPal payments are all options available to users.

- Set up and schedule automatic payment reminders.

- Convert estimates and proposals into invoices.

Pros

- Freshbooks is easy to use and can run from desktop to mobile.

- Good choice for freelancers and solopreneurs.

- Sending professional invoices, tracking expenses, and managing payments are simple now.

- Billable hours are trackable and can be added to invoices.

- Manage your finances on the go, receive notifications about invoices, and respond to client questions with just a tap.

Hangups

- Some advanced accounting features are missing, such as inventory management or in-depth financial reporting.

- Adding more users can become expensive.

Pricing

FreshBooks offers a tiered pricing structure with three main plans: Lite, Plus, and Premium, along with a customizable Select plan for larger businesses.

- Lite: $7.60/month (60% Off for 4 Months)

- Plus: $13.20/month (60% Off for 4 Months)

- Premium: $24/month (60% Off for 4 Months)

- Business Plan: Contact via website

Quick Evaluation

- Version – Cloud, Mobile, and Desktop

- Free Trial Available– Yes, for 30 days

- Pricing Discount Available– Tier Pricing available + Depends on business requirement

- Phone and Chat Support- Yes

- Average Rating– 4.5 out of 5 on average, based on 4402 reviews. (Source: GetApp)

Worth Reading: FreshBooks: Is It the Ideal Accounting Solution?

5. Xero invoice

Xero is a software-as-a-service (SaaS) based model product. To access it, you need a subscription. This cloud accounting software tool is compatible with desktop, cloud, and mobile devices.

How Xero Makes Invoice Simple and Easy

- Xero automates many bookkeeping tasks, such as sending invoices, categorizing bank transactions, and reconciling bank statements.

- You will get a clear overview of accounts payable and cash flow.

- Allow you to schedule batch payments in advance.

- You can track the status of your invoices and see when they have been paid.

Standout features

- Xero integrates with several payroll add-on services, which can help businesses automate their payroll process.

- You can send invoices, automate reminders, and much more from any device.

- Get receipts and bills into Xero with Hubdoc.

- Manage online file storage, sort files, and share documents, contracts, bills, and receipts.

- With Avalara’s auto sales tax, you can calculate and automate sales tax reports with greater ease.

How is Xero best for invoicing?

- Create, send, and track professional invoices to customers after their successful payment.

- Businesses can track their cash flow and make sure they have enough money to cover their expenses.

- Xero can generate a variety of reports, such as profit and loss statements and balance sheets. These reports can help business owners understand their financial performance and make better business decisions.

- See future cash flow, check financial health, and track metrics with Xero Analytics.

- Its user-friendly interface allows you to operate the app even without any accounting know-how.

Pros

- Its cloud-based convenience allows you to access the software across the globe via the internet.

- Xero continuously adds new features to its software automatically, ensuring that users take advantage of the most recent developments in accounting technology.

- Expand app functionality and customization with its easy integration and a wide range of third-party applications and plugins.

- Allows you to share real-time data within a team or with other team members.

- Automate almost all your accounting tasks and save time and effort.

Hangups

- It will take time to become an expert user of Xero.

- The inventory management, purchase, and requisition functions of Xero are regarded as basic and lack more sophisticated features, which are essential for many modern businesses.

- The advanced features do not justify the Xero pricing.

Pricing

Their pricing plan is designed to cover all the accounting essentials, from startups to large-size businesses.

- Early-Stage Enterprise: $15 per month

- Growing Enterprise: $ 42 per month

- Established Enterprise: $ 78 per month

Quick Evaluation

- Version – Cloud, Mobile, and Desktop

- Free Trial Available– Yes, for 30 days

- Pricing Discount Available– Tier Pricing available

- Phone and Chat Support- Yes

- Average Rating– 4.5 out of 5 on average, based on 2912 reviews. (Source: Software Advice)

6. Clio

Clio is a cloud-based law firm billing software designed for law firms of all sizes. This legal billing software centralizes information and automates numerous tasks to help law firms operate more profitably.

Likewise, you can automate many tasks associated with running a law firm, including client intake, contact management, calendaring, document management, timekeeping, billing, and trust accounting.

How Clio Makes Invoice Simple and Easy

Clio, a legal billing software, streamlines the invoicing process for law firms in a few ways:

- Clio makes paying invoices for law firms simple.

- This law firm’s billing software streamlines almost every aspect of the legal billing process, all the way from recording time to ultimately receiving payment.

- The Clio Payments option helps your clients pay their bills easily with the methods they prefer. Customizable payment plans can allow clients to pay large bills in small, manageable amounts on a pre-scheduled basis.

- The Clio Payments option facilitates your business’s ability to accept client-specified payment methods.

- With this legal billing software, you can send bills electronically using Clio’s secure client portal with just a send button.

Standout features

- Lawyers and staff can track time spent working on a client’s file, and it automatically populates invoices with this information.

- Allow you to create, schedule, and send automated text reminders to keep potential clients in the loop.

- Clio provides pre-made invoice templates that can be customized to fit the specific needs of a law firm.

- It integrates with payment processing services, allowing clients to pay invoices online with a credit card or through other digital methods. This eliminates the hassle of mailing checks or waiting for bank transfers.

How is Clio best for invoicing?

- Allow you to create invoices, control the delivery of invoices, and promptly send bills and reminders so that your client has no excuse to put off paying.

- Generate invoices with clear descriptions.

- Securely store and manage documents.

- Keep track of deadlines and calendars.

Pros

- Clio’s intuitive interface allows novice users to use it without training

- One of the best chat support services is available. Which is available around the clock and the devices.

- You can organize notes, contact information, documents, tasks, time tracking, and invoices.

- Clio’s Word processor integration allows for easy document storage.

Hangups

- Often shows the difficulty in integration with cloud accounting software like Quickbooks.

- Document search functionality is limited.

- Subscription costs can add up, especially for larger firms.

- Very short trial period, only for 7 days.

Pricing

Clio offers several tiered pricing plans for their legal software, ranging from $39 to $139 per user, per month after the trial period.

- EasyStart: $39/month/user.

- Essentials: $79/month/user. Add-ons available.

- Advanced: $109/month/user. Add-ons available

- Complete: $139/month/user. Add-ons available

Quick Evaluation

- Version – Cloud, Mobile, and Desktop

- Free Trial Available– Yes, for 7 days

- Pricing Discount Available– Tier Pricing available

- Phone and Chat Support- Yes

- Average Rating– 4.7 out of 5 on average, based on 1606 reviews. (Source: Getapp)

Also Read: Top Accounting Software for Property Management in 2025

Conclusion

Hope, these small and medium-sized businesses will benefit greatly from this invoicing and billing software. These invoicing software will operate on the latest technologies. It is very difficult for you as an entrepreneur or business owner for SMEs to hire an onsite team. However, you can take advantage of outsourcing your accounting team or individual. This will not increase your budget and also allow you to avail of the services without compromising the work quality.

Count on us for seamless account management with our top-tier software solutions. Get in touch today!

Last updated on: Nov 17, 2025